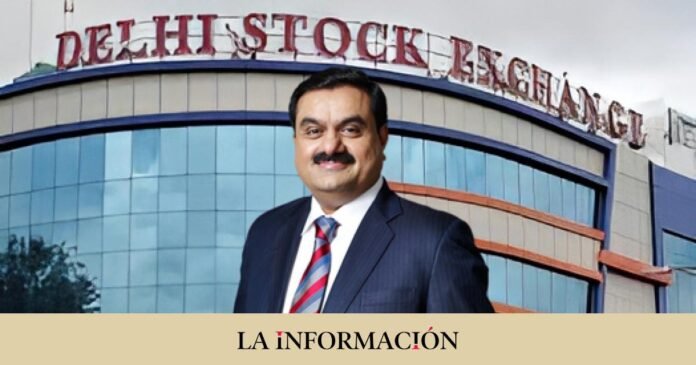

Since his meager beginnings in the 1980s, Gautam Adani has become India’s richest citizen. But now, in just a few days, the foundations of his sprawling empire have been shaken. On January 24, Hindenburg Research, a small New York investment firm, published a report calling the Adani Group “the biggest scam in corporate history.”

The Indian group responded by saying the report was “maliciously twisted”, “without analysis” and was intended to “sabotage” the shares of the group’s flagship publicly traded company, Adani Enterprises. The group also commented that Hindenburg had released his report “without making any attempt to contact us or verify the company.”

“We are deeply concerned by this willful and reckless attempt by a foreign entity to mislead the investment community and the general public,” Adani lawyer Jatin Jalundhwala said. Hindenburg published his report on billionaire Adani’s dealings, accusing the group of “blatant market manipulation and the largest Ponzi or fraudulent scheme in decades.”

Collapse of 70,000 million in the stock market

In this, the opening of a short position in the Adani Group is guaranteed, which means that it would benefit from the fall in its value in the markets. Since the Hindenburg report was published, Adani’s business empire has lost more than $70 billion of its stock market value. The infrastructure mogul’s net worth has also plummeted by about $30 billion, according to the Bloomberg Billionaires Index. Still, he remains the richest man in Asia, with a personal fortune of more than $92 billion, $10 billion more than his compatriot Mukesh Ambani.

The Adani Group had already denounced the Hindenburg report as “baseless” and “malicious” in its initial response a few hours after it was published, and said last Thursday it was considering legal action. On Sunday, he published a long and angry rebuttal of more than 400 pages, calling Hindenburg’s protests “baseless and discredited” and claiming the analytics firm had an “ulterior motive.”

“This is fraught with conflicts of interest and is only intended to create a fake stock market to allow Hindenburg, a self-confessed bear speculator, to make huge financial profits through illicit means at the expense of countless investors,” the company said.

Hindenburg took a short position in Adani’s companies through US-traded bonds and non-Indian traded derivatives. Under his umbrella, 38 fictitious companies have been discovered in the Mauritius Islands, a fictitious offshore network used to manipulate profits and so on that has created a debt giant of almost 23,000 million dollars.

rapid expansion

The 60-year-old tycoon founded the Adani Group more than 30 years ago and is considered a close ally of current Indian Prime Minister Narendra Modi. Before the plunge on Wall Street, which continued Monday on the Mumbai stock market, markets had applauded the businessman and his breakneck pace of expansion. Investors bet on the businessman’s ability to grow his business in sectors that Modi had prioritized for the development of the country.

In its detailed response on Sunday, the Adani Group described the US short seller’s report as an “attack” on India, its economy and its investors. “This is not simply an unwarranted attack on a particular company, but a calculated attack on India, on the independence, integrity and quality of Indian institutions, and on the country’s history of growth and ambition,” he said.

Hideburg concluded his report last week with 88 questions directed at the Adani Group. Questions ranged from asking for details about the group’s offshore entities to why it has “such a convoluted and interrelated corporate structure.” The Indian conglomerate called those questions “rhetorical insinuations that color rumors as facts.” Next, it will try to answer them and some tables and graphs will be published to support their position.

The lengthy retort came from reassuring investors about the group’s debt, banking relationships and corporate governance practices. Shares of Adani Enterprises, the group’s flagship company, rose more than 4% on Monday, but most Adani stocks extended losses from last week. The outcome of this story is yet to see its climax.