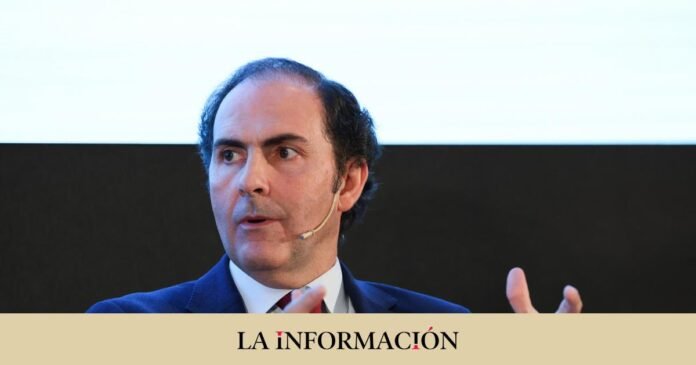

The purchase operation of Air Europa by Iberia faced with two decisive months, in which the preferential negotiation right of the latter expires, whose president, Javier Sánchez-Prieto, has set that date to close a process that has been open for more three years old

After the reduction of the initial price of 1,000 million in cash, agreed by both parties in November 2019, to the 500 million that was agreed in January 2021, once the pandemic had already broken out and Air Europa had received 475 million euros of the fund created by SEPI to help strategic companies face the drop in activity, the two actors in the process continue to clear up their discrepancies.

Juan José Hidalgo, the president of Globalia -the business group that owns 80% of Air Europa-, always asked for more, and he expressed it in public. For its part, Iberia argued that its competitor was worth less, both because of the loan it had received from SEPI and the 140 million it owed to the ICO, which raised the debt to over 600 million euros.

Competition is suspicious of the operation

The pitfalls between the two airlines also come by way of competition, because both the European and Spanish authorities in this matter view with some misgivings an operation that involves concentrating the market, especially in Latin America, although Iberia has failed to level the ground.

In fact, Sánchez-Prieto said in mid-January that the airline of the competing group in Europe of the benefits that the purchase has for the entire sector and, specifically, for customers.

Meanwhile, Iberia took over 20% of Air Europa last August, after converting the 100 million euro loan it had made to the Globalia airline into capital in March and which gives it preferential negotiation rights (which expires in March), given that another large European group, Air France-KLM, was also tempting the Hidalgos.

battle for the asian market

IAG also does not rule out forgetting and liquidating this operation and looking for other allies, but the union with Air Europa would give the strength that the Madrid operating center needs to compete with the four big Europeans: Amsterdam, Frankfurt, London-Heathrow and Paris Charles-De Gaulle .

The battle with these large air traffic centers is played out in the Asian market, a growing and very attractive niche, in which the two large Spanish airports (Madrid and Barcelona) barely have around 5% movements, close to 20 points below competitors.

So far, the Government has not made a clear statement on the operation, alleging that it involves two private companies, but it does show that it likes the idea of reinforcing the operational center or “hub” in Madrid.

Is the alternative to buy TAP?

Meanwhile, other options are emerging, such as the possibility of buying the Portuguese public TAP, whose privatization is an option for the Portuguese socialist government, which intends to integrate it into a large aviation group, according to the local press, including IAG.

But TAP is immersed in a restructuring plan of its own, with workforce and asset reductions, and has a load of buyers. The company’s accounts show signs of improvement -in the third quarter it reached net profitsbut the Portuguese airline only plans to achieve financial sustainability in 2025.