Spanish investment funds are beginning to recover from the market turbulence and managed to close January with a joint return of 2.4%. They do so after last year’s blow, when they posted a media loss of 8.4% due to the war, inflation and the rise in interest rates. According to data released by Inverco, variable income ‘made in Spain’ pulls the bandwagon and posts gains of more than 8%.

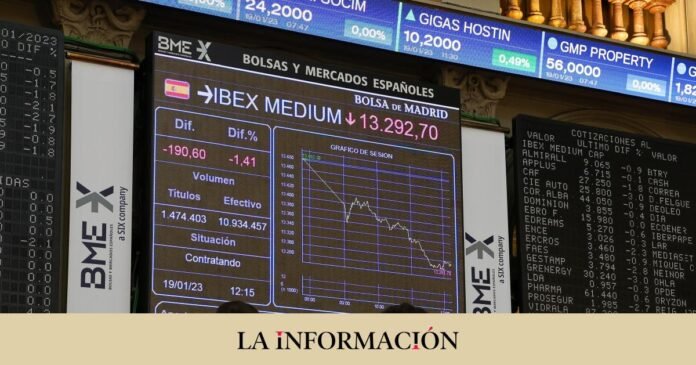

Together with international equity funds (+5.98%) and mixed equity funds (+3.18%), this investment category is the one that leads the ranking due to its high exposure to shares. The good tone of the financial markets, which has led the Ibex 35 to close its best January since 2001, and of fixed income after the corrections of the last twelve months are the factors that explain this return of returns to the ground positive.

The exception is marked by the monetary funds that add a 0% return, while mixed fixed income (+1.98%) and fixed income (0.95%) also experienced increases. “The long-term public debt once again presented a change in trend by registering decreases in the yields of the bonds, causing increases in their prices,” adds from the employers’ association.

The optimism of the market has also been noted in net deposits. Specifically, these have been 3,200 million euros, an unprecedented figure since 2018 during the month of January and chains 27 months of increased contributions. Of this amount, the bulk of net deposits (2,700 million) have been used for long-term fixed-income products, including target return and guaranteed products. “Following the trend of the previous months, the most conservative vocations maintain the investor interest of the national participant, in an environment of general rate rises, which increases the attractiveness of the categories with greater exposure to bonds,” they explain.

The trend changes when comparing in percentage terms. In this case, the acceleration of the stock market has boosted national equities and adds an increase in assets of over 2,600 million. In the global calculation, investment funds are close to their all-time high after reaching 316,823 million, 3.5% more than in December 2021.