The European Central Bank (ECB) settled speculation on Thursday about a sudden pause in the monetary tightening cycle with two executive decisions and a promise. The proven facts are, first, that interest rates in the euro zone rise by half a point, to 3.5%; second, the ECB confirms a balance adjustment of 60,000 million euros in four months, until June. In exchange, his proposal to calm investors’ spirits is that he will not hesitate to intervene in the market if things go wrong with his most powerful monetary tool: the TPI, or instrument for the protection of monetary transmission.

The mere reference to the anti-crisis shield of July 2022, or superbazooka of unlimited asset purchases, dependency for the ECB to withstand the financing conditions without blinking an eye in the middle of a banking storm outside the EU. “We believe that he maintained a cautious tone, understanding that markets were looking for reassurance following the adverse events in the US and Swiss banking sectors. However, this was not even a moderate reversal; Madame Lagarde emphasized that the ECB had more to do if it met their forecasts and whether the risks to financial stability have decreased,” say analysts at the investment bank Nomura.

“In our view, this is not the end for the ECB, and we still expect it to hike rates further. We believe it is likely that members of the ECB Governing Council will provide further guidance on further rate hikes once they The recent nerves in the financial market have dissipated, and probably not until the lightning launch of core inflation in March, which we believe could exceed 6% and force the ECB to do more,” they add in the Japanese firm.

In fact, Christine Lagarde did not rule out a rise in rates on May 4, although she hid behind the ‘meeting by meeting’ and data-dependent approach to avoid any guidance in this regard. However, her presentation did provide clarity for an interbank market that is confused with extreme movements in indices such as the Euribor, which had not been seen to date. If yesterday she discounted almost a drop in rates after plummeting to 3.36% before the ECB’s action, today she should climb back above 3.5% after hearing her words.

Emergency liquidity at discretion

Everything seems to have changed in a matter of a week. The Federal Reserve (Fed) has reopened the liquidity taps to the maximum with a temporary increase in its balance of 300,000 million in liquidity to banks through its emergency window and for the FDIC loans linked to the collapse of the SVB and Signature bank. In addition, the regulators have coordinated with the 11 largest banks in the US a rescue of the First Republic Bank to inject 30,000 million in deposits to its balance sheet and nip in the bud the episode of bank panic unleashed during the last week.

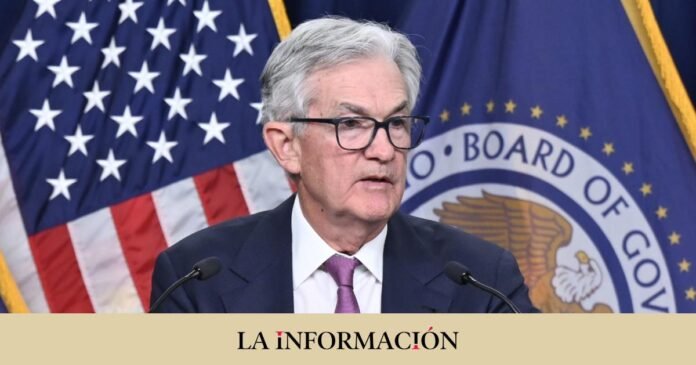

Just days after Fed Chairman Jerome Powell warned on Capitol Hill that he was ready to speed up rate hikes again in March, this crisis has called on his office to influence his ahead of the policy meeting. Tuesday and Wednesday currency. Will you dare to raise rates to 5%? Or will he back down under pressure? Anyone not familiar with Powell’s recent career should know that he is tenacious and cold as ice. He was one of the few within the Administration that withstood the attacks of Donald Trump when in 2019 the president demanded that he lower types under threat of dismissal and all kinds of insults.

Despite everything that has happened, or that firms of the stature of Goldman Sachs have ventured to signal a pause in rates next week, Powell’s steps seem headed for a new movement in line with Lagarde’s position. The doctrine seems clear in the two most powerful central banks: demand and understanding, higher rates and liquidity on demand and at the discretion “if necessary” to de-stress those who need it. They are the two sides of the same coin in the race to tame inflation before it escalates again like in 2022, without prejudice to ensuring financial stability. There is no swap or dilemma, according to Lagarde, but both policies are compatible and complementary.

The firmness of the French bank gave a glimpse to the eyes of some listeners of his press conference that he was in until yesterday. The currency has become an additional source of inflation for Europe in the last year and the central bank’s governing council seeks to avoid it. Hence Lagarde’s speech seems to assume that Powell will move if, as it appears, the US bank fire is under control.