Deposits versus mortgages. The rise in interest rates by the European Central Bank (ECB) has painted a very different picture in the two basic businesses of banks: raising liabilities to lend. Thus, if the change in the monetary policy of the body chaired by Christine Lagarde has caused the cost of credit to rise to below but close to the Euribor, the same has not happened with the cost of deposits, especially of large banks, which is below 1% in Spain.

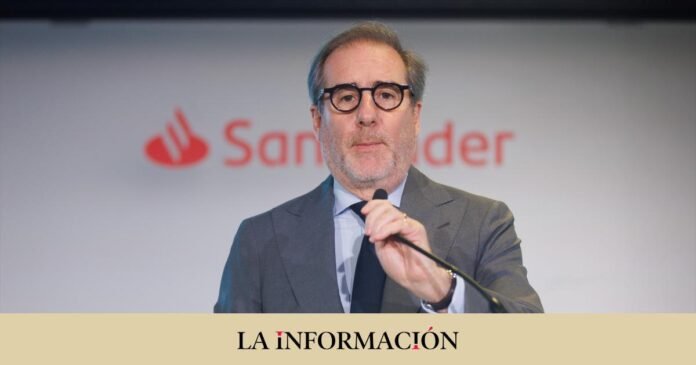

However, Banco Santander has broken a spear in favor of the sector. “Spanish banks are giving mortgages below what banks charge in other countries,” such as Germany with a level of risk similar to the Spanish, insisted the CEO of the entity, Héctor Grisi. Precisely from the same bank has defended the idea that the important thing is that financing costs do not rise because it affects a mass of customers much wider than deposits.

In this regard, Spanish entities have defended in the presentations of results of the first quarter, when the remuneration of deposits was the hottest issue, that 80% of the balances in deposits are below 20,000 euros. Figures that coincide with those of Banco Santander. During the meeting after the presentation of results with journalists, the bank insisted that 75% of its deposit base corresponds to this type of private clients and about 80% was protected by the Deposit Guarantee Fund.

On the other hand, the cost of credit stood at 3.80% for Banco Santander in the first six months of the year, while in the case of Bankinter it closed at 3.73%. Levels that are in line with the average price of mortgages for Spain published by the ECB, which stood at 3.71%, 13 basis points above the European average. In addition, Spain is the second country by size with the cheapest mortgages, only behind France, with 2.88%.

“Mortgages in Spain are cheaper than in Europe. barely exceed by 22 basis points the cost of Spanish debt,” referring to the ten-year bond, Grisi said. On the other hand, in Germany, a country similar to Spain, the average cost of mortgages stands at 3.91%, 147 additional basis points with respect to the country’s long-term debt, which moves around 2.44%. As for the prices of deposits, banks insist that it is not true that savings are not being remunerated. Thus, this ratio has been rising since the start of the rise in interest rates by the ECB. In the case of Banco Santander and for Spain it closed the first six months of the year at 0.72% from 0.53% in the previous quarter, while Bankinter stood at 0.74%.

Families take the opportunity to pay to repay mortgages

As for the evolution of credit, both Bankinter and Banco Santander have confirmed that the rise in interest rates, and its effect on the Euribor, the index to which most mortgages are referenced and which has exceeded 4% in monthly rate, has boosted the repayment of mortgages. Another reason explained Héctor Grisi so that among the clients the remuneration of fixed-term impositions is not urgent.

In that sense, customers who have funds use them to amortize mortgages, both partial and total, at a rate of 300 million euros per month, clarified the bank’s CEO. This means that Spanish families are not over-indebted, since they pay the loans in 10-15 years, compared to other markets, such as the British, where this leverage causes it to end up exhausting the entire life of the loan. In fact, the bank pointed out that since the real estate crisis bank credit has fallen by 35%.

And this amortization of mortgages means that the credit to acquire housing has closed at 350,000 million euros in the first six months of the year, which represents a decrease of 2% year-on-year, in line with the average of the sector, which would be 2.4%. At the moment, the exception would come from Bankinter, the other entity that has presented results until June, which would remain stable with an increase of 0.4%.