The stock market punishment on BBVA returns after finally presenting its purchase offer for Banco Sabadell despite the entity’s rejection. The proposal is the same, only that the initial euphemism of the proposed merger plan takes a backseat to become a ‘hostile takeover bid’. The price is trapped by the exchange equation, in a proportion of 1 BBVA share for every 4.83 Sabadell shares. Investors penalize BBVA (-5%, 9.74 euros) for the ‘dilutive effect’ of a capital increase that will involve the issuance of 1,126 million new shares, 16% of its share capital, to absorb Sabadell ( +5%, 1.9 euros), which is triggered to collect the premium offered, which remains in the

The ‘fluid takeover’ values 100% of the entity at 11,585 million euros taking Wednesday’s closing as a reference, although it is reduced below 11,000 million after this Thursday’s reaction. The offer is conditional on obtaining more than 50.01% of the share capital of Banco Sabadell, the approval of the General Meeting of Shareholders of BBVA and the approval of the National Markets and Competition Commission (CNMC) and the of Prudential Regulation. From United Kingdom. The closing of the operation would take place in a period of between six and eight months, once the necessary authorizations are received. JP Morgan, UBS, Rothschild, Garrigues and DWP advise BBVA in its assault on Sabadell.

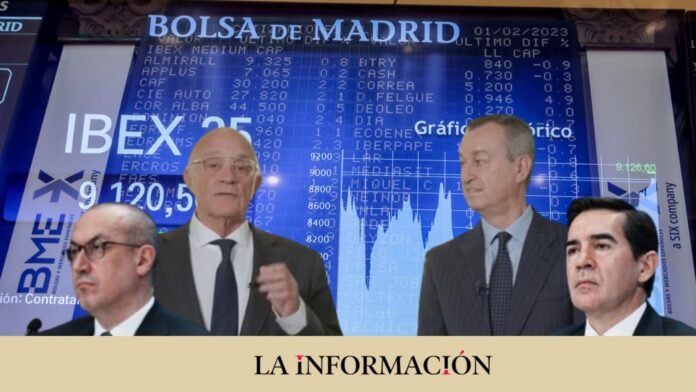

Major shareholders of BBVA and Sabadell

BlackRock is the main shareholder of BBVA with 9.16% of the capital adding the aggregate indirect positions of all its funds and ETFs, followed by Vanguard (5.2%) and Capital Group (4.9%), according to Bloomberg data . The passive money of these firms is grouped around 20% of the bank’s property. The Norwegian sovereign fund (3.1%), JPMorgan (1.3%) and Goldman Sachs (1.2%) are BBVA’s largest partners. On the part of Sabadell, Vanguard declares 3.5%, the Norwegian fund another 3.1% and the Mexican David Martínez Guzmán (Fintech Advisors SARL) another 3.5%.

If it goes ahead, the hypothetical ‘megabank’ that arises from the union of BBVA and Sabadell would create a group on the stock market with a stock market valuation of 75,000 million euros, with data as of Monday’s close, similar to that of Banco Santander. The asset perimeter of both entities would exceed one trillion euros, with 556,000 million in loans to customers, 600,000 million in deposits, a joint income (interest margin) of 36,600 million and an annual net profit of about 0 million euros. according to data collected by ‘La Información’.

With data at the end of March, according to Europa Press, the new Sabadell-BBVA would have 688,363 million euros in assets in Spain alone, which would put it ahead of CaixaBank (613,457 million) and Santander (468,807 million). By market share, the future firm would become the bank with the largest footprint in Catalonia with a market share close to 40%, overthrowing the traditional reign of La Caixa in the banking business.

On an international level, Sabadell also contributes its British subsidiary TSB and BBVA has the digital activity of Atom, an integration viewed favorably by analysts. In Mexico, BBVA has a dominant position that would be reinforced with Sabadell’s incipient activity in that country. Outside of those markets, Garanti in Turkey and BBVA’s South American subsidiaries would propel the new group to the podium of euro entities.

Potential synergies are estimated at 850 million euros before taxes and would offer BBVA greater geographic exposure to developed markets. “The bank’s exit from the US in 2020 left it more exposed to emerging markets, with Mexico, Turkey and South America representing 45% of its loans at the end of the first quarter of 2024,” explained the rating agency Fitch in a presentation last May 1.

In Spain, Banco Sabadell is a leader in SMEs, with a share of 12.7%, compared to 11.5% for BBVA; While BBVA is stronger in retail banking, with a share of 14.7%, compared to Sabadell’s 6.3%. “They are two very complementary banks, both due to their geographical diversification and their strengths in customer segments. One of BBVA’s priorities in the integration is to preserve the best talent of both entities. Principles of professional competence and merit, without adopting measures traumatic and with all the guarantees,” he explains in his presentation. Furthermore, BBVA anticipates that the technological integration of Sabadell will take between 12 and 18 months.