The price of housing in tourist areas is already only 5.9% below the maximum that was reached in the second quarter of 2008, just before the financial crisis triggered the bursting of the brick ‘bubble’. In these areas, the square meter stood at an average of 2,873.3 euros at the end of March, compared to 3,053 euros fifteen years ago, taking as a reference the appraisal value collected by the Ministry of Transport, Mobility and Urban Agenda ( Mitma) in their reports. The difference is notable in relation to non-tourist areas, where the price of real estate is still 26% below the record set on those dates.

In the case of tourist areas, the value of houses rose by 5.7% on average in the first quarter, while in non-tourist areas it did so by 4.9%, so that the differential between the two widened to an unprecedented level in the country since before, even, the Great Crisis. This rise in the cost of real estate occurs despite the strong pressure exerted on this market by the interest rate increases that the European Central Bank (ECB) has been applying since last summer and which have become a sharp rise in the price of the financing, both for variable-rate mortgages -whose reference indicator is the Euribor- and for the supply of fixed-rate loans.

There are several reasons that explain this evolution. The greater resilience of demand, especially foreign demand, the shortage of new-build housing supply and the high construction costs “have been supporting housing prices in recent quarters despite the sharp increase in interest rates “, points out from CaixaBank Research. It so happens that international buyers depend less on credit and tend to use more savings when buying real estate in Spain, so they are less affected by the ECB’s monetary policy decisions.

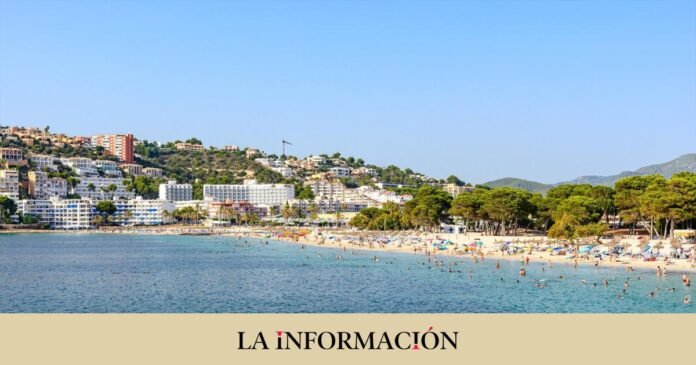

Already last year the purchase and sale of housing by foreigners shot up 45% in the whole year to 88,800 operations, a record level according to the Association of Registrars. Its operations accounted for 13.8% of the total, in line with the weight they usually have in this market (around 13%), although in a year in which sales rose to 650,000, the highest volume also since 2008. And to all of the above is added, as explained by the merged entity, that in tourist areas there is also a “high demand” by national buyers, both for first and second residences.

Foreigners earn pesos in home sales

These figures confirm the “great attraction” that the Spanish real estate market continues to have within the European environment. Faced with the slowdown in the number of sales by the national buyer, the foreign investor now appears as the “great engine” of Real Estate, says Ferran Font, Director of Studies and spokesperson for the real estate website pisos.com. According to his calculations, only three autonomous communities account for 65% of the total operations of foreigners in Spain, the Valencian Community, with 30%, Andalusia, with 21%, and Catalonia, with 14%.

Despite the fact that, according to the General Council of Notaries, the purchase of homes fell by 11.4% in May in relation to the same month of the previous year, the mortgage firm fell much more strongly, 23.9%. All in all, the drop in this last variable is much lower than that registered by other neighboring countries, as explained by the ING research service. In the Dutch bank they attribute it precisely to the pull that foreign demand has been registered by having relaxed the restrictions imposed to deal with Covid in both 2020 and 2021.

“Property shortages also remain a persistent problem. Demand has outstripped supply in recent years” from tourism, which has also supported the property market. In fact, the National Accounts data for the first quarter placed the national economy as the one that grew the most in year-on-year terms in the entire European Union, with an advance of 4.2%.

Neither abrupt drop in the price of apartments nor market collapse

All in all, this slowdown in the national demand for housing has contributed to a marked deceleration in the rise in prices. “With a reduced number of potential buyers, sellers face fiercer competition, resulting in reduced pricing power,” an incident from ING. In the firm, they agree with other analysis houses and point to a slowdown in the housing market this year due to the rise in interest rates, although they rule out a severe correction in prices or an abrupt drop in activity.

First, because the lower energy bill reduces the uncertainty of homes and frees up an additional budget to dedicate to the mortgage; secondly, because income will continue to increase as nominal wages recover after the strong loss of purchasing power they recorded last year -when inflation averaged 8.4%, according to the National Institute of Statistics-. The strength of the labor market also ensures steady growth in gross national income.

Finally, there is the scarcity that will be generated by the fact that demand continues to increase structurally in the coming years in the face of a slower progress in supply, which will exert upward pressure on property valuations. Due to all of the above, from ING they foresee that property prices will increase by barely 1% this year and that they will stagnate next year.