The French fund Antin, through GCE LuxCo, has presented this Wednesday to the National Securities Market Commission (CNMV) the request for authorization of the voluntary public offer of acquisition (OPA) of shares on Opdenergy Holding, which will mean disbursing almost 866 million euros to take over the renewables group.

In a communication to the stock market supervisor, the inadequate fund which, after completing the appropriate competition law analysis, considers that it is not necessary to obtain any competition law authorization in relation to the offer and, in particular, It is not necessary to notify or obtain authorizations from the National Commission for Markets and Competition (CNMC) by virtue of the provisions of Law 15/2007, of July 3, on the Defense of Competition; nor from the Federal Trade Commission and the Antitrust Division of the United States Department of Justice.

Likewise, on June 28, it requested authorization from the Council of Ministers to invest in Opdenergy before the General Directorate of International Trade and Investment of the Ministry of Industry, Trade and Tourism. In addition, Antin has presented, together with his application, two bank guarantees granted by Banco Santander and by Crédit Agricole Corporate and Investment Bank, Branch in Spain, as guarantee entities for a total import of 865,995 million euros. The Spanish financial entity covers 519,597 million euros -60% of the guarantee- and the French 346,398 million euros -the remaining 40%-.

On June 12, the French fund announced the presentation of a euro. 75% of the share capital.

Thus, this friendly offer follows a previous agreement with the founding shareholders of Opdenergy -Gustavo Carrero, Javier Chaves and Javier Remacha-, who together owned 71% of the company and have signed irrevocable commitments to sell all their shares to the offeror. Two of the founders who have signed irrevocable acceptance commitments will reinvest part of the funds obtained in GCE BidCo if the offer is settled successfully, with Gustavo Carrero Díez, through Marearoja Internacional, and Alejandro Chaves Martínez, through Aldrovi, hold up to 10% of the share capital of GCE BidCo each after the settlement of the offer and the completion of the reinvestment.

Another of the group’s reference shareholders is Indumenta Pueri, the owner of Mayoral, which owns 6% of the capital of the renewable energy firm, although it is not yet known whether or not it will attend the offer. Thus, the minimum acceptance condition will be met if, in addition to the shareholders who have already signed up to sell, other shareholders holding shares representing 3.813% of Opdenergy’s share capital accept the OPA.

Maintain headquarters in Spain

Furthermore, the fund, which has more than 30,000 million euros in assets under management through its different investment strategies, intends to maintain Opdenergy’s headquarters in Spain and intends to maintain close collaboration with the strong management team current to take advantage of future opportunities.

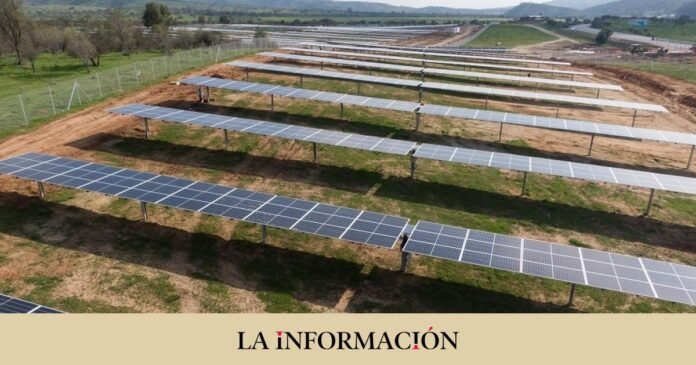

If the operation goes ahead, Antin will take over an independent vertically integrated renewable energy developer and producer that has 904 megawatts (MW) in operation, 951 MW under construction and pre-construction -with data at the end of March- and a track record in the development of renewable energy projects, mainly in Spain, the United States, Chile, Italy and Mexico.

Opdenergy’s business model is primarily based on long-term private power purchase agreements (PPAs) with private entities. Thus, 70% of its production is contracted with long-term PPAs with highly solvent counterparties, and to a lesser extent for the sale of energy to the market.