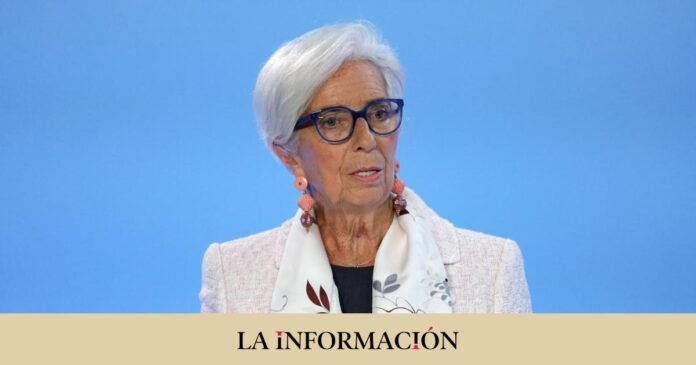

The more restrictive monetary policy of the European Central Bank (ECB) threatens to put companies’ investment decisions on ‘stand by’. According to data from the organization chaired by Christine Lagarde, the companies had not been so expensively financed since the end of 2008, in the year in which the markets saw Lehman Brothers and the US financial system fall. Thus, the rate applied to Spanish companies stood at 4.52% at the end of June, the highest level since December 2008. For the average of European companies, interest is even higher, up to 4.79%, a level that is not it came from exactly that same date.

In this escalation it is behind the ECB’s monetary policy. A year ago, the average interest applied to companies for new operations was only 1.42% in Spain, which implies an increase of 218% in our country in just twelve months and 209% for the European average. according to data from the body chaired by Christine Lagarde.

This is causing companies to choose to postpone their investment decisions. As Juan Fernando Robles, professor of economics at UDIMA, recalls, it was an expected effect because it is precisely what the ECB is looking for with the rise in interest rates (in July they were already at 4.25%). However, Robles explains that it has negative effects since the financing of companies depends on two variants, “business profits and current interest rates”, which has a negative impact on companies “because they have it more difficult to finance working capital and reduces investment possibilities”, explains Robles.

In other words, requesting a loan to meet recurring expenses, such as paying suppliers, or to boost activity, such as business expansion that would require new machinery or new premises, can be postponed. Not to mention that the increase in the price of money acts like a wheel: demand falls and companies have to adjust the stock, moderating orders and avoiding even more financing the surplus.

Something that is already beginning to be noticed in the macro data, with a weakening, globally, of the PMIs. In this regard, Ben Laidler, global markets strategist at eToro, explains that “the constant weakening of the leading PMI indices on a global scale is a reminder of the weakening of the growth rate. The global manufacturing sector is already in recession and the dominant sector of services are slowing down.”

In Spain, another example would be the national accounting data published by the National Statistics Institute (INE) last Friday. It can be seen for the second quarter of the year that the year-on-year variation in the industry was zero when compared to the same period in 2022, when the coronavirus restrictions were ended.

Biggest problem for small businesses

The biggest problem with this increase in the cost of credit is, for the moment, smaller companies. It should not be forgotten that in Spain, small and medium-sized companies represent 90% of the business fabric and are heavily banked. What does this mean? Robles recalls that at the moment when financing is going to become more expensive due to higher interest rates, access requirements are also supported since financial institutions perceive a “greater risk” in this type of company. “They are more vulnerable to these changes, some may close (those that were already going through a more complicated situation) because they could not stand without financing,” he points out.

Another aspect is that their benefits also decrease in the future since they cannot carry out investments that allow them to grow. A situation that large companies do not escape either. “They have more options because a company can go to the market and they don’t have to go through the bank.” But this does not mean that they are not affected by it either.

In the Ibex 35 there have been two examples of this in the last two days. Naturgy has chosen to reduce investments, while Cellnex has taken advantage of its greater liquidity position to increase repayments, above what was expected by the market. Precisely, Robles admits that those companies with sufficient liquidity can choose to deleverage and this type of operation is also reflected in the statistics of the Bank of Spain. In the last twelve months, the amount of outstanding balances of loans to non-financial corporations has been reduced by 11,091 million euros.