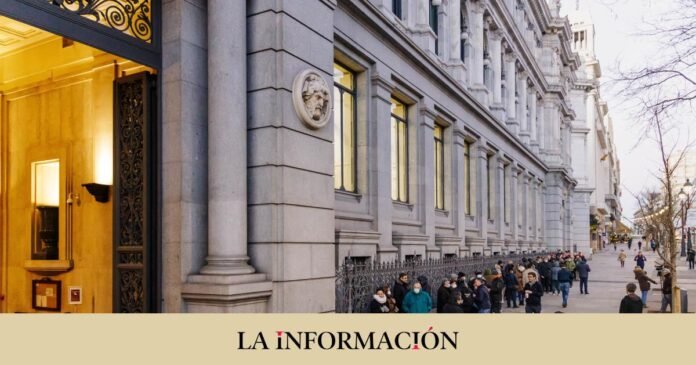

Treasury Bills have become the financial product par excellence of 2023. The gradual rise in interest rates and the initial refusal of the banking sector to remunerate deposits has led investors to bet on the paper. Nobody has given more interest. This has been evident through the long queues of private savers that have formed at the Bank of Spain. Although they have not done so physically, Spanish companies have also joined this ‘boom’ through their financial departments, doubling the holding of Letters in their portfolio.

According to data from the Bank of Spain, non-financial companies have allocated a total of 6,371 million to Treasury Bills until June (latest data available), an amount that represents almost doubling the figure recorded at the end of January (3,324 million) and multiplying by 223% the volume compared to the end of December 2022, when it barely reached 1,971 million. Although there is a slight reduction in the amount placed in June compared to May, the rebound has been escalating throughout the first semester.

“The financial directors of the companies have decided to allocate the treasury directly to the Letters, with which they obtain three or four times more profitability than if they bet on a deposit,” says Víctor Alvargonzález, founder and CEO of the independent advisory firm. Nextep Finance. Despite this, the amount they allocate is less than the more than 16,600 million that households have accumulated in the same period, compared to the 1,826 million they recorded at the end of 2022, which means shooting 800% more.

Its behavior has been in line with the evolution of the profitability of Letters, which has reached maximum levels in a decade, although in some sections it is already showing signs of stagnation. In the auction held last Tuesday, the interest on six-month bills has experienced a minimal rise from 3.665% to 3.679%, its highest level since 2012 and twelve months it remains at 3.8%, similar to that of the previous placement.

This evolution is recorded a week before the meeting of the European Central Bank (ECB), about which there is great uncertainty as it is not clear whether it will carry out what may be the last rate increase, predictably of 25 basis points, until the 4th. ,5%. The message that the president of the Frankfurt-based organization, Christine Lagarde, conveys next Thursday will depend on the direction they take from now on.

Despite this, “demand is going to be maintained for a season,” according to the investment director of Finaccess Value, Alfonso de Gregorio. The expert argues this decision on the fact that the ECB will take time to decree a reduction in interest rates, despite the fact that the pause is close, given that inflation still remains at high levels. Therefore, the bills present a path as an investment, at least in the short term.

Together, companies have channeled almost 9% of the Letters issued which, at the end of June, exceeded 71,000 million euros, the lowest figure of the year after experiencing a gradual reduction. Of this amount, the horrible part is in the hands of foreign investors, who concentrate more than 23,000 million, in addition to households. The rest is distributed between money market funds and financial intermediaries (8,152 million), which includes investment funds or insurance companies, among others; monetary financial institutions (12,947 million) or public administrations (3,250 million).