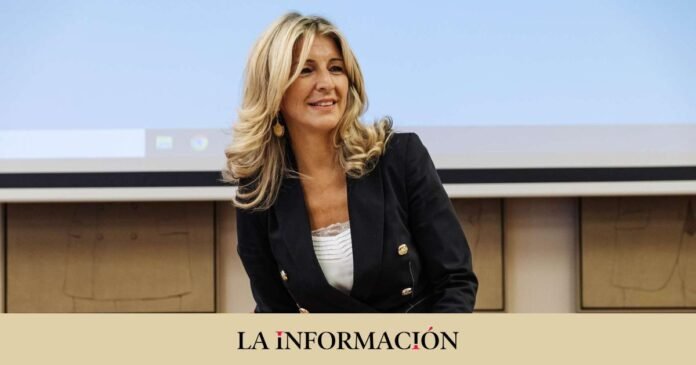

Yolanda Díaz opted to veto the entry of foreign investors on the board of Telefónica. The leader of Sumar and second vice president of the acting Government, proposes that the entry of any foreign investor be only to obtain a financial return and that they cannot be part of its board of directors, nor exercise or assign their voting rights.

“At Sumar we demand that the entry of any foreign investor into its capital (in reference to Telefónica) be conditioned on the following elements; the first of them, they cannot be part of its board of directors,” Díaz advances.

Likewise, these investors “cannot exercise their voting rights, nor assign them, therefore limiting themselves to maintaining an investment that only seeks to obtain a financial return,” Díaz defended this Wednesday during his speech at the meeting with the Sumar parliamentary group in The deputies congress.

Díaz has pointed out that Telefónica is a “strategic” company and has pointed out that its activity guarantees the country’s digitalization process, but it also manages “millions and millions of data from companies” and “our lives.”

STC Group announced its entry into the Telefónica shareholding at the beginning of September, where it expects to control 9.9%, through the acquisition of 4.9% in shares and another 5% through derivatives, which it will execute to convert into shares once obtained the relevant authorizations.

The acquisition by the Saudi group of that stake, valued at 2.1 billion euros and which will make it the first shareholder of Telefónica, requires the approval of Defense.

“The time has come to activate all resources to guarantee the strategic autonomy of our productive apparatus, ensure independence and, above all, our future,” Díaz assured.

Strengthen the anti-takeover shield and the role of the SEPI

With the aim of protecting strategic sectors – which he considers must be redefined – Díaz has defended that Sumar’s proposal involves legally improving the anti-takeover shield and moving towards an industrial model with controlling stakes by the State Society of Industrial Participations . (SEPI) in the shareholders of strategic companies.

Among Sumar’s proposals, Díaz has pointed out that they also want to recover the gold share for strategic decisions such as mergers, spin-offs, headquarters transfers and other operations.

“The time has come for Spain to resolve its problems in strategic sectors and go forcefully, boldly and defending the interests of our country,” he said.

Díaz asks to preserve the integrity of Celsa

Díaz has also referred to the case of the Celsa steel company, where a court ruling gave way to the company’s restructuring plan that allows the company’s creditor funds to become shareholders of the company and control it.

“We must preserve its integrity, the integrity of employment, and the corporate headquarters in our country, this is key at this time,” said Díaz.

The leader of Sumar has pointed out that it is “key” to maintain his activity and the steel company, which he has considered to have a “very valuable” business model and that some “opportunistic” investment funds want to take over it.