Endesa is advancing in its objective of strengthening its presence in the Iberian market for renewable generation, especially in Spain, while focusing on the digitization of its distribution network, improving the quality of service and the transformation of processes and systems . . The electricity company thus maintains commitments to acquire immobilized material goods for import of 1,352 million euros, which represents an increase of 23% compared to the end of 2022.

According to its semi-annual financial report, the investments will materialize mainly in the next 12 months, counting from the beginning of the second half of this year. Specifically, 648 million euros will go to investments related to renewable production facilities and will mostly remain in Spanish territory. For its part, it will allocate 290 million to the marketing area, where it groups expenses in advertising or the development of projects for third parties, such as the installation of solar panels through its energy services subsidiary Endesa X.

Likewise, it has reserved 412 million euros for the distribution business, which only operates in Spain. According to the company itself, this amount will be used to extend or improve the network, with a focus on digitization, strengthening and increasing the resilience of assets, improving service quality, and transforming processes and systems. . . “The digitization and automation of the network is thus an essential element to ensure that consumers and current and future producers can access electricity and so that they do so with a higher quality supply and with fewer interruptions,” they point out from Endesa. .

Management of new energy uses

In this way, one of the priorities for the company is the development of intelligent networks, the ‘smart grids’, to manage new energy uses such as distributed generation, self-consumption or electric mobility. These increase the level of reliability and quality in the supply. For example, when there is a fault they can detect and isolate the problem, helping power recover quickly and return to emergency services first.

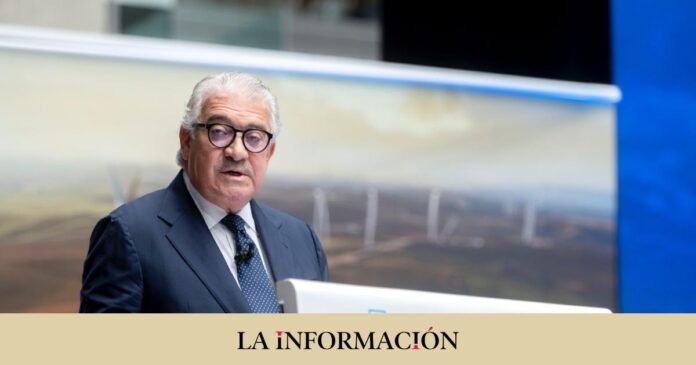

The two million missing to complete the total amount correspond to Structure, Services and Adjustments. These more than 1,300 million euros fall within the framework of its 2023-2025 strategic plan, which it presented in November of last year and is expected to be updated in the same month of the current year. The electricity company run by José Bogas increased investment by 15% compared to the previous 2022-2024 plan, up to 8,600 million euros. Its mission is to conquer a ‘green’ installed capacity of 13,900 MW, compared to the current 9,500 MW. For this game alone, it will allocate 4,300 million euros, that is, half of the plan.

The new renewable power that will be added to the company’s energy ‘mix’ thus grows by 10%, up to 4,400 MW. Of these, 68% will be solar and the rest, wind. According to the company, 91% of the peninsular generation park will thus be free of emissions at the end of 2025 (72% at the end of 2022). This growth in renewables is supported by a project portfolio of about 85 gigawatts (GW), of which 14 GW are in a state of mature administrative processing and just over 1,000 MW are already underway. 58% of the portfolio is solar, 16% wind and another 20% correspond to battery storage projects, a technology that is incorporated as a novelty compared to the previous plan.

On the other hand, 2,600 million will go to the digitization of the network, while it plans to multiply by five the charging points for electric vehicles in the period, reaching a total of 66,000. And as announced by its parent company, almost all the energy at a fixed price that they sell, 95% of it, must come from ‘green’ origins, that is, from sources that do not emit pollution.

Sale of part of its gas business

Endesa continues to study a possible divestment of the ‘B2B’ part of its gas business. This is the supply of gas to large industrial and business customers. The deal was announced by its parent, Enel, in November last year, but there hasn’t been much progress since then. The company manages a supply portfolio of 6,000 million cubic meters (bcm) in the Iberian peninsula and plans to dispose of two bcm.

The company closed the first half ratifying the main financial objectives for the year: 4,400-4,700 million ebitda (gross operating profit), 1,400-1,500 million net ordinary results and a dividend per share of around 1 euro, after Win 879 million. The figure is 4% lower than that of the same period of the previous year, although the company specified that discounting extraordinary items, net profit grew by 20%. This magnitude -the ordinary result- is on which the company calculates the dividend to be distributed, which it expects will grow to 1.2 euros with a charge to the results of 2024, with Enel as the main beneficiary (it controls 70% of the Spanish ).