The near crisis experienced by banks in March, with the purchase of Credit Suisse by UBS, put the focus on bank liquidity ratios. Despite the fact that the waters returned to their cause and that European banks have levels above what is required by the regulator, the European Central Bank (ECB) will intensify its surveillance on it. Thus, the banking supervisor has confirmed that from next September the institution will ask banks to report weekly on the evolution of this variable.

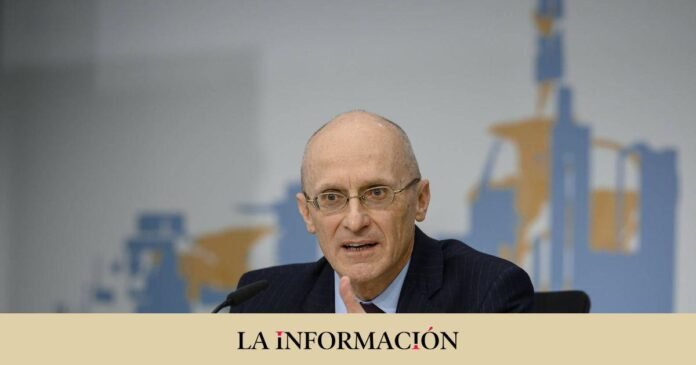

“We decided to send the banks, starting in September, a request for weekly information, in order to have more recent data that allows us to better monitor the evolution of liquidity.” This has been confirmed by the president of the ECB Supervisory Board, Andrea Enria, in an interview with the Italian newspaper ‘Milano Finanza’.

Along these lines, Enria believes that it will be useful to review the frequency of monitoring reports. This is not new. The European Banking Authority (EBA) itself had already recommended it. The reason is that the reports on the liquidity coverage ratio of the entities are only available monthly and, moreover, with a certain delay of a few weeks.

“To be honest, my main point of reference is not SVB, but Dexia,” Enria explained, recalling that the Belgian entity passed the 2011 stress tests, but lost access to financing in two weeks and went into crisis, because the valuation of its assets at market value took advantage of the erosion of the level of capital.

During the interview, Enria insisted that “the recent crisis teaches us an important lesson. In normal times, markets monitor metrics for capital, liquidity, profitability, etc.

Thus, for the ECB supervisor it would be better to further strengthen the balance sheets and liquidity position of the banks. The Italian also referred to the recent stress tests of the banks and that will be published this Friday by the EBA. The ECB member has indicated that these will reflect the best starting point of European banks, with much higher capital levels and much more solid and reliable asset quality.