Swords fly low at Naturgy. The possible exit of the CVC and GIP funds from the gas company’s capital is approaching and Criteria Caixa has taken charge of the operation with the aim of ensuring stability in the shareholding through a buyer who looks after the interests of the company. company in the long term, while IFM looks askance

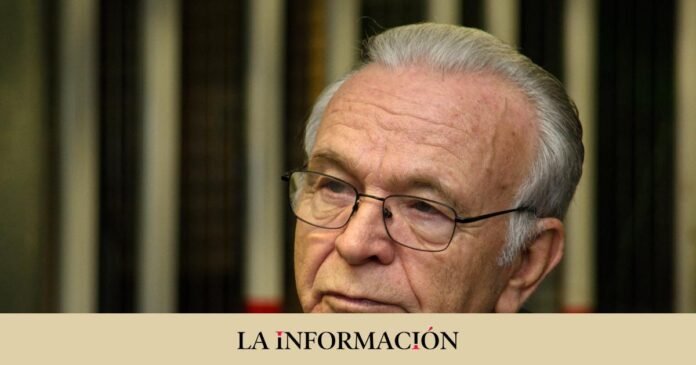

CriteriaCaixa, chaired by Isidro Fainé, prepares the landing of the fund to replace the outgoing CVC and GIP, but IFM remains in the background, as happened when it launched the takeover bid for the energy company with which it aspired to acquire between 17% and 22.69% of the capital, but which ended up reaching 10.8%. A percentage that has risen to the current 15.01% over time. For its part, the investment holding company of the ‘la Caixa’ Foundation chose to strengthen its shareholding while the Executive was studying the entry of the Australian fund, going from 24.8% to 26.7% today, and with the aspiration of reaching up to 29.9%.

“The strengthening of the position in Naturgy will be carried out in accordance with the provisions of current regulations and following the recommendations of the CNMV without, in any case, exceeding the legally established threshold to formulate a takeover bid (30%)”, he communicated. Criteria in mid-May 2021. The controversy continued with the entry of IFM into the board of directors. The takeover bid ended in October 2021 – ten months after its launch – and Jaime Siles did not join the Naturgy management body until the end of 2022, when the ‘Geminis’ project was announced to split the gas company into two.

Criteria Caixa was reinforced on the board due to the entry of IFM

Months passed like this and they made a move to reinforce Criteria’s power when the Australian fund became part of the board. To introduce Siles to the board of directors of Naturgy without increasing the number of directors, two independents, Francisco Beli and Ramón Adell, resigned. However, Adell became a proprietary director by co-option of Criteria Caixa. In this way, Criteria Caixa strengthened its position, going from two to three directors. The holding company is followed by CVC and GIP, with 20.7% and 20.6%, respectively, and two seats. For its part, the Argentine state company Sonatrach owns 4.1%.

Naturgy’s board is currently made up of twelve members – the company’s statutes establish a minimum of 11 and a maximum of 15 -, with its president, Francisco Reynés, as the only director with the category of executive. The rest of the members of the energy company’s board are independent and proprietary.

However, the last ‘clash’ between Criteria and IFM occurred at the last general meeting of shareholders, which was held on April 2 in Madrid. Naturgy reported after the meeting that the annual remuneration report was approved – although the vote is merely consultative – by 76% of the capital, compared to 2% against. And at this point is where the surprise came. IFM decided to abstain from the report that validates Reynés’s salary in line with what Criteria Caixa did last year and the assessment of the ‘proxies’. However, minutes after the meeting ended, Criteria issued a statement informing of its approval of the report after abstaining from the previous year, and giving new support to the Mallorcan executive.

“Commitment as a long-term investor to the industrial project”

“Criteria Caixa, the holding company that manages the business assets of the la Caixa Foundation, wants to reaffirm its commitment as a long-term investor to the industrial project of Naturgy, a company of which it has been the main shareholder for decades,” he said, evidencing his desire for maintain power in Naturgy, which is also a source of income for the ‘la Caixa’ Foundation through dividends. Thus, under this scenario, he has confirmed that he is in talks to reach a “partner agreement” to protect Naturgy’s shareholding after the possible departure of CVC – and even GIP -.

Several alternatives and none is ruled out

The relevant event in which he announced the negotiations with a “potential investment group”, whose name he did not reveal but it sounds like Taqa (a renewable subsidiary of the oil company, according to CincoDías), left the door open to any avenue to give him entry. One of the options is that the Emirati fund keeps the 41.3% that they own between CVC and GIP, or that even a part goes to increase the ‘free float’ (working capital has already been warned by letter by). of the Stock Market (CNMV) to increase liquidity through a capital increase or the sale of securities held by its four largest shareholders.

This possibility would force a takeover bid for 100% of the energy company and would entail a shareholder agreement like the one signed with Repsol in the former Gas Natural Fenosa. Criteria intends to agree on the management of the company with the new investor to retain control and have influence on important decisions.

Any of the operations would last until 2025

Another alternative is for CriteriaCaixa and the United Arab Emirates fund to share 20.7% of CVC, with the former raising its stake to 29.9% and the latter keeping the remaining 17.5%, placing it third in the shareholding ahead of IFM. and given the slightest urgency to sell from BlackRock, which bought GIP in January and inherited the stake in the gas company. In any case, the investment arm piloted by Fainé said yesterday that the talks are in a very preliminary state and we could go to 2025 for any operation.

“Criteria is not a party to the conversations between said third party and the rest of Naturgy’s shareholders and therefore does not have any type of information in this regard,” he stressed, so it is not necessary to completely rule out that the operation could go awry and It finally comes to nothing. Naturgy closed yesterday’s trading session with a stock market rise of 3.36%, reaching 21.52 euros per share. The price shot up to 9% (22.7 euros intraday maximum) from the minimum of more than three years in which it was moving. On the Government’s side, do not enter into valuations that may involve advances or speculation, especially when it comes to a listed company. Criteria, CVC, IFM and Naturgy itself do not comment.