Low office occupancy rates worry muni investors. Since Covid, around 27% of the US workforce has been remotely working at least part-time, according to data from the US Bureau of Labor Statistics. The question, however, is whether the country’s cities have a card to play in the revenue space.

From the Bay Area to Boston, the declining number of offices has raised many questions. Some muni investors fear that declining office occupancy – a side effect of increased labor flexibility – could undermine big-city maples.

However, although this unemployment continues to be a cause for concern, most North American cities have mechanisms in place to protect their finances and those of their municipal bondholders.

“First, we need to address a misconception: America’s cities aren’t as reliant on business and office taxes as many believe,” says Richard Schwam, AllianceBernstein city high-yield analyst. “It is true that taxes on real estate are usually the largest source of tax revenue in large cities, but they represent only 30% of total revenue, on average, according to the Urban Institute, and office taxes only a part” adds the expert.

In fact, of the largest US cities by outstanding debt, taxes on commercial or office real estate represent only 6.8% of total revenue, on average. It seems that it is a situation that, on paper, could be somewhat contained. Cities have other important sources of income.

These include user fees, such as sewerage and parking fees, income taxes, sales and use taxes, and intergovernmental transfers. The ability to draw on a wide range of funding sources means that even a 50% drop in office property tax revenue would represent a 3.4% decline, on average, in total revenue, which, in In our opinion, it is not a debilitating challenge for cities.

Unlink taxes from real estate values

Even in the event that office real estate experiences a sharp decline in valuation, cities have mechanisms in place to mitigate or even nullify the effect on real estate taxes, cushioning the budgetary impact of the decline in real estate value.

For example, Chicago sets its property taxes regardless of the value of the real estate. The process is similar in most New York State cities, where annual property tax increases are limited to 2% or the rate of inflation, whichever is less. “This decouples taxes from real estate values, although it does not limit tax rates or assessed values,” according to Schwam.

“And while New York City property taxes are more closely tied to real estate values, changes in the value of the city’s taxable income are spread over five years… This limits the risk of loss. in a given year and gives the city time to adjust to the evolution of values”, adds the expert from the US manager.

Similarly, a report on remote work from Goldman Sachs argued that, thanks to similar mechanisms across the United States, municipal property tax revenues are somewhat “insulated from the general real estate disturbances.”

As a 2008 Federal Reserve study notes, real estate taxes have a beta of 0.4, which means they rise or fall 40% more than the overall housing market. Also, this relationship tends to be lag by three years, giving cities time to adjust.

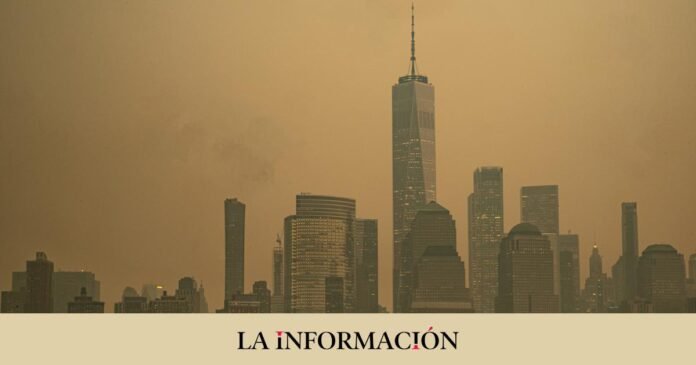

Most investors are concerned about the value of office real estate in the new world of hybrid work and remote work. The shrinking workforce can undermine the vitality of urban centers and have a multiplier effect on businesses that rely on foot traffic. Rising interest rates are also making it more difficult to finance office real estate, putting further pressure on valuations.

Some analysts estimate that the value of office real estate has fallen by around 30% since March 2022 8% in the last 12 months to June 30, 2023, with very low sales volume.

Public debt of cities

The trump card of large municipal bond issuers is that, as government entities, they can change the rules to protect themselves from economic changes. For example, in response to the rise of e-commerce, many states have enacted laws that allow them to collect sales tax from online retailers with no physical presence in the state.

In a similar vein, we expect cities to reallocate their tax authority to capture changes in economic activity away from offices and toward more active uses. As long as cities attract people, governments will find a way to tax them.

“This should provide some confidence to municipal bondholders,” says Schwam. According to Moody’s, the median cash balance for US cities as a percentage of expansion revenue rose to 71% in 2021 from 34% in 2023, helping cushion weakness in the office market.

“We believe that the outlook for US urban centers is not as bleak as some have argued… for secular decline,” says the manager.

Unlike a time when deindustrialization caused a decades-long exodus, America’s cities have the tools to weather generational shifts in the way Americans live and work, which could be good news for both cities as well as municipal bond investors who place their trust in cities.