The entry of the Saudi group STC into Telefónica, which a few days ago announced the purchase of 9.9% of the Spanish telecom company for 2.1 billion euros, adds to a list of operations that the Government will have to authorize by having the so-called ” “Anti-opas shield”. “which limits foreign investments.

In recent months, several operations have been affected by this regulation and are waiting to be authorized by the Council of Ministers. Among them, the Celsa industrial group stands out, in which a court ruling has approved the restructuring plan proposed by the creditors, giving free rein for the funds to become shareholders of the company, replacing the current owners, the Rubiralta family. . .

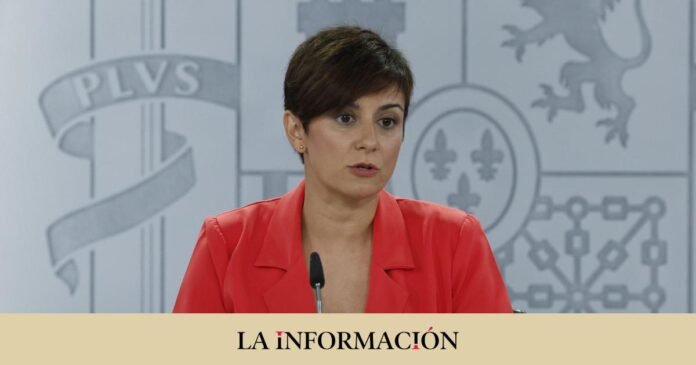

In this sense, the first vice president of the Government and acting Minister of Economic Affairs, Nadia Calviño, explained a few days ago that the Executive will respect the judicial decision, but will ensure that employment and the strategic interests of Spain are protected.

This same week, the counter-takeover launched by the British company Amber, owned by the ISQ and TDR funds – based outside of Spain – was also known, over 100% of the shares of the inspection and certification company Applus, improving the offer launched in June by the American fund Apollo.

In the document sent to the CNMV, Amber herself acknowledges that she needs the approval of the Government to take control of Applus, which has a turnover of more than 2,000 million a year and the counter-bid values it at 1,250 million.

Also waiting for a response from the Government is GCE Bidco, an entity controlled by funds managed by the French company Antin, which presented at the beginning of the summer a voluntary cash takeover bid to acquire all the shares of the renewable company Opdenergy, which means valuing the company at 8 66 . millions.

What is the Government’s anti-takeover shield?

The arrival of STC to Telefónica, which has been rejected by the second vice president of the Government and acting Minister of Labor, Yolanda Díaz, must be submitted for approval by the Council of Ministers, thanks to the “anti-takeover shield” in force .

This regulation was approved in March 2020, coinciding with the outbreak of the pandemic, through a royal decree that required prior authorization for foreign direct investments made by residents outside the EU and the European Association. . Free Trade Agreement (EFTA, or EFTA -in English-), for reasons of security, public order and/or public health.

Furthermore, in November 2020, it introduced a transitional provision in that same text that established that the Government must also authorize foreign direct investments carried out by EU and EFTA companies in listed companies or even in unlisted ones if the investment . exceeded 500 million euros.

This prior authorization regime, which was designed in a context also marked by the Australian IFM fund’s takeover of Naturgy, applies both to investments made by EU and EFTA companies and to those undertaken by companies based in Spain whose beneficial ownership corresponds to residents of other European countries.

It seeks to protect Spanish companies in strategic sectors against possible direct investments in which an investor, taking advantage of the situation, acquires a stake equal to or greater than 10% of the share capital or takes control of a Spanish company.

Last July, the Government updated this regulation to adapt it to the European regime, with changes to which companies and which operations must have prior authorization, shortening the deadlines and establishing a series of exemptions to the prior authorization regime.

Among the changes, it is established that it is mandatory to request authorization from the Council of Ministers whenever 5% of the capital is reached, but those who acquire between 5% and 10% could skip this step if they agree not to enter the councils. . of administration.

Telefónica Board of Directors

The possible entry of the Saudis into the capital of a company considered strategic, with access to critical infrastructure, has provoked reactions of all kinds, with the Government ensuring that it would study the operation “very carefully” to ensure the interests of all stakeholders. Spanish people.

Along these lines, the acting President of the Government, Pedro Sánchez, has defended this week that the Executive will guarantee that “national defense and security are safe at all times.” “The limit that exists for foreign investment is the protection of our legitimate national interests,” he warned.

STC Group expects to control 9.9% of Telefónica’s capital, through the acquisition of 4.9% in shares and another 5% through derivatives, which it will execute to convert into shares once the pertinent authorizations are obtained, placing itself as the first shareholder. of the Spanish telecom, as long as it obtains the approval of Defense.

To analyze the operation in depth, Telefónica will hold a board of directors meeting on September 27, which will be ordinary and its call is part of the activity of the teleco, which usually meets this body at the end of the month.