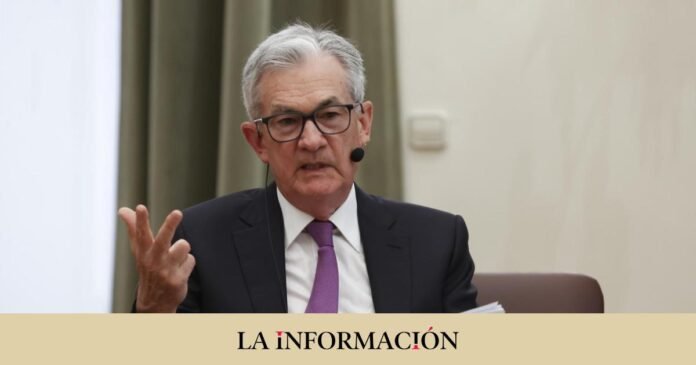

The Federal Reserve of the United States (Fed) has raised in its role as supervisor of the US banking sector the application of controls on the stricter levels of capital to a greater number of entities, including those banks with assets of at least 100,000 million dollars is (91,160 million euros), as indicated by the vice president for the supervision area, Michael S. Barr.

“I will recommend that the enhanced capital rules apply to banks and bank holding companies with $100 billion or more in assets,” the Fed official said on Monday, noting that with this threshold more banks will be a little off. the capital rules more sensitive to risk compared to the current framework, which is applied internationally active or with at least 700,000 million dollars (638,118 million euros) in assets.

For the Fed vice chair, this stricter approach is appropriate, the proposed rules are less onerous for banks to implement than the current requirements, since it does not require a bank to develop a set of internal models of operational and risky credit risk for the calculation of the capital regulator. Likewise, with the still recent bankruptcies of Silicon Valley Bank (SVB) and other regional entities, Barr has stressed that recent experience shows that even banks of this size can cause stress that can spread to other entities and threaten financial stability.

“The risk of contagion implies that we need a greater degree of resilience of these firms than we previously thought, since the losses that the bankruptcy of a certain entity entails for society are greater, and the probability that another bank will fall victim to the another’s failure is greater,” he said.

In this way, the proposed definitions would require banks to at least match the regulatory capital ratios, since they would better reflect the actual loss-absorbing capacity of banking entities.

“We need to strengthen capital standards for big banks”

In this sense, he points out that this circumstance was an important part of the set of events that triggered the bank run against SVB, arguing that if the bank had already been required to include those losses in its reported capital, it would have been less likely that the market and would s depositors thought the same way. “Obviously, the bankruptcies of SVB and other banks this spring were a warning that banks must be more resilient and need more of what is the basis of that resilience, which is capital,” defended the vice president of the fed. “We need to strengthen the capital standards for the big ones,” the banks have summarized.

In this regard, it has announced that the process will be deliberative and open to public participation, so the implementation of any agreed changes will take at least several years. “By strengthening capital standards, we are ensuring that companies will have credit to grow and hire workers, and face the ups and downs of the economy (…) Our goal is a financial system that works for everyone, and have rules solid capital is essential for this”, he added.