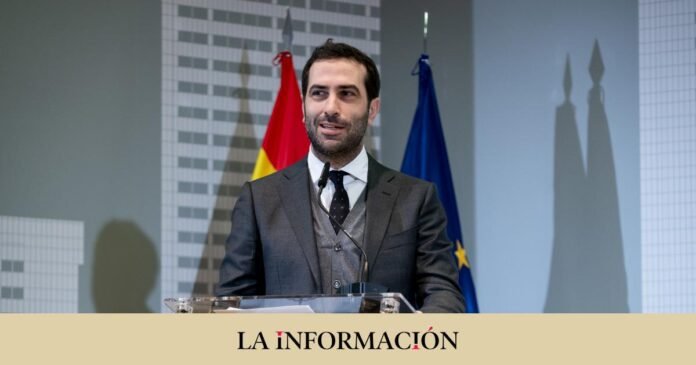

Carlos Body, Minister of Economy, Commerce and Business, assured today, Friday, that the Government is studying the details on how to carry out the specific financing of the purchase of up to 10% of Telefónica by the State Participation Company. Industrials (SEPI). The acquisition would take place in parallel with the negotiations on the 2024 General State Budgets, which are paralyzed by the Popular Party’s veto in the Senate.

“It is an operation that was decided a few weeks ago and we are studying the details,” said Body in statements to Bloomberg TV reported by Europa Press.

On December 19, the Council of Ministers ordered the SEPI, an organization dependent on the Ministry of Finance, to purchase up to 10% of Telefónica’s share capital with the aim of providing the Spanish operator with greater shareholder stability and contributing to the safeguarding of its strategic capabilities. “The SEPI will proceed to carry out the procedures and actions that allow the process to be launched to, minimizing the impact on the price, complete the acquisition of the necessary volume of shares,” the Government stated then.

“The presence of a public shareholder in Telefónica will reinforce its shareholder stability”

“The presence of a public shareholder in Telefónica will reinforce its shareholder stability and, consequently, to preserve strategic capabilities of essential importance for national interests,” the Ministry of Finance stated a few weeks ago.

The Government argued in December that the entry into the capital of the telecommunications company was in line with that of other European countries, since Germany participates in the capital of Deutsche Telekom; France, has in Orange; and Italy adopted an agreement last summer to increase its participation in the company that brings together Telecom Italia’s fixed telephony assets to 20%.

The entry of STC into Telefónica’s shareholding

The Government’s decision to enter Telefónica came a few months after the Saudi ‘teleco’ STC – 64% controlled by the Government of Saudi Arabia through the sovereign fund PIF (Public Investment Fund) – suddenly burst into Telefónica’s shareholding with 9.9% of the company’s share capital.

This operation, which was forged without Telefónica’s management being aware, consisted of the acquisition of 4.9% of shares directly and 5% through financial derivatives. The regulations in force in Spain regarding foreign investments in strategic listed companies state that the Executive must give permission to non-EU investors who intend to acquire more than 10% of a company of this type.

However, this threshold is lowered to 5% in the case of companies with interests in the field of national defense, such as Telefónica. When the purchase of 10% of Telefónica by SEPI is completed, the state-owned company will become the operator’s main shareholder, ahead of STC and the stable core of Telefónica shareholders, formed by BlackRock, BBVA and CaixaBank. When SEPI acquires 10% of Telefónica, it will have the possibility of acquiring a seat on the company’s board of directors.

About the approval of the 2024 Budgets

Regarding the approval of the 2024 Budgets, Corpus has highlighted that the Spanish Government has “a lot of confidence” in carrying out the Budget Law and has stressed that “all the efforts” it has been making since the second legislature began are aimed to test the Budget law for 2024. This, he highlighted, will be essential to meet the Spanish Government’s objectives of ending 2024 with a budget deficit of 3%.