The world’s largest bloc of emerging market economies is growing by six and the increase in BRICS membership points to aspirations for a new world order. The objective? It seems to end the hegemony of the US dollar. However, as China continues to have much more economic weight than all the others, the importance of the upcoming enlargement of this group of countries will be more diplomatic than economic.

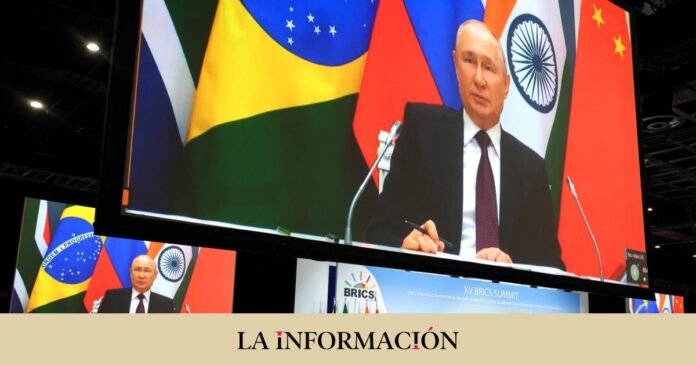

Fortunately, few economic acronyms last long. Even fewer renew their relevance over time. BRICS, acronym for Brazil, Russia, India, China and South Africa, have so far proven to be an exception. The group recently announced its intention to add Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates to its ranks.

The news suggests the aspirations of a new economic order, with the issuance of a new currency, since the combined share of the expanded bloc in the current world GDP, around 30%, is approaching the increasingly smaller portion of the G7 pie (43%). And it’s about triple what it was in 2001, when then-Goldman Sachs economist Jim O’Neill first coined the term BRICS.

But if you look closer, the new BRICS looks a lot like the old one. China’s 18% of global GDP, up from 3.9% in 2001, dwarfs all others. This group of countries has changed its share of world GDP over time. India (now at 3.3%), Brazil (1.9%) and Russia (2.2%) have made only very modest progress in the last two decades, while South Africa, which joined the group later, has maintained its share of world production (0.4%). Assuming the six new members join, they will jointly contribute 4% of global GDP (Argentina’s accession is uncertain, as the two main candidates in October’s presidential elections oppose it).

de-dollarization

The BRICS also want to de-dollarize, both among themselves and with their trading partners, while exploring new intra-BRICS options for cross-border payment systems or correspondent banking relationships, according to the joint statement from their August summit. “But these things are harder to do than to say while the US dollar represents 59% of global reserves and half of global trade, according to data from the Bank for International Settlements,” Fidelity experts comment in a recent report.

The Chinese renminbi is the only BRICS currency with a large enough share

The Chinese renminbi is the only BRICS currency with a large enough share of allocated global reserves (2.6%) for the International Monetary Fund to count it independently outside of “other currencies”; The rest are G7 currencies. “It is not likely that any will threaten the dominance of the dollar for at least a generation,” the North American manager states. “Not to mention that the BRICS share of world trade, at 16%, is less than half that of the G7 (33%),” she adds.

Where the new BRICS can move the needle is in giving the ‘Global South’ more of a voice when it comes to issues of multilateral diplomacy. With the exception of the United Arab Emirates, the poorest G7 nation (Japan) is better off than all members of the expanded BRICS in terms of GDP per capita, according to World Bank data. It may seem obvious, but the economic and political priorities of developing countries (such as the BRICS) and richer countries (such as the G7) do not always coincide.

“For example, large differences have recently emerged over all kinds of issues, from the war in Ukraine to global decarbonization goals to representation on the UN Security Council,” Fidelity highlights. Although O’Neill initially considered the BRICS to be an economic phenomenon, today it increasingly appears that the bloc’s weight is shifting toward the diplomatic sphere. Geopolitics will continue to greatly impact the strategic decisions of the economy. The pillars are already being laid.