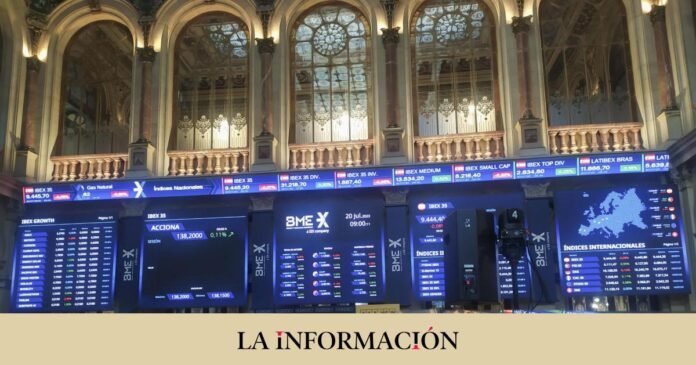

The Ibex 35 is trading flat at mid-session this Thursday with a fall of 0.02%, taking the index below 9,348 points. Federal (Fed), in which the members of the Monetary Policy Committee warned of upward risks in inflation, rule out a recession in the US economy in 2023, but see room to raise rates further.

After finishing practically unchanged yesterday, the Ibex 35 extends its sideways dance despite the negative tone of the Japanese Nikkei, which today closes with losses of 0.6%, and Wall Street, which also ended with falls. The markets wake up with bad data from Japan and are waiting for new macroeconomic references this Thursday, such as the trade balance of Spain and the eurozone, as well as new applications for unemployment benefits in the United States.

Trade like the best on eToro

Follow the actions of other eToro traders in real time with CopyTrader™

Copying an investor does not equal investment advice. The value of your investments may go down as well as up. Your capital is at risk.

Like the Ibex 35, the main European stock markets woke up today with losses. Paris, London, Frankfurt and Milan also left around 0.1%. In the early moments of today’s session, the biggest increases within the Ibex 35 are for Grifols (+0.5%), Unicaja Banco (+0.39%), Sabadell (+0.37%), Bankinter (+ 0.33%) and Santander (+0.28%). At the other extreme, the most pronounced falls are for Cellnex (-1.1%); Amadeus and Acciona, which fell a little more than 1%, and Fluidra and ArcelorMittal, whose shares lost almost 1% in both cases.

On the energy scene, the price of a barrel of Brent quality oil, which serves as a reference in Europe, increased by 1%, reaching 84.5 dollars, while Texas-type oil (WTI) stood at 80, 3 dollars, which represents an increase of 1.3%. In the foreign exchange market, the price of the euro against the dollar advances to 1.0882 ‘green tickets’, while in the debt market, the interest demanded on the Spanish 10-year bond scales up to 3.747%.