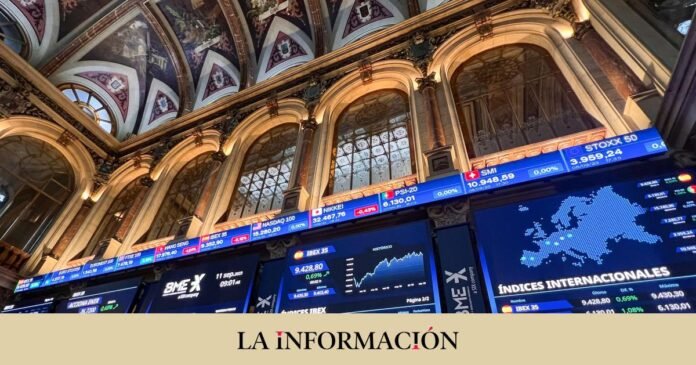

The Ibex 35 opens the week with falls. The Spanish stock market reference registers a drop of 0.16% at the opening, but retains 9,500 points after the brake last Friday. The lack of macroeconomic data leads investors to keep an eye on the Federal Reserve’s meeting this Wednesday, with a rate pause as the most likely scenario. Thus, Paris drops 0.54%, Frankfurt gives up 0.29%, Milan slows down 0.28% and London is trading practically flat (-0.05%).

Invest like the best on eToro

Imitate the actions of other eToro investors in real time with CopyTrader™

Copying an investor does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Until now, the uncertainty surrounding central banks was how far they would raise rates. However, from now on the focus will be on the signals that can anticipate when the first drop will occur and which central bank will apply it. “The market will have to adapt to a reality that is probably harsher than its hopes are even today, because we consider any rate reduction by the Fed unlikely before the end of 2024,” say Link Securities analysts.

In this context, back to Spain, most of the values are trading in the red. The increases in Repsol (+1%), Sabadell (+0.67%), Aena (+0.35%), CaixaBank (+0.14%), Logista (+0.08%) and Endesa (0.08%) stand out. ,1%). Regarding the falls, Acciona Energía (-1.8%), Meliá (-1.28%), Amadeus (-1%), Rovi (-1%), Indra (-0.99%) stands out. and Colonial (-0.8%). ).