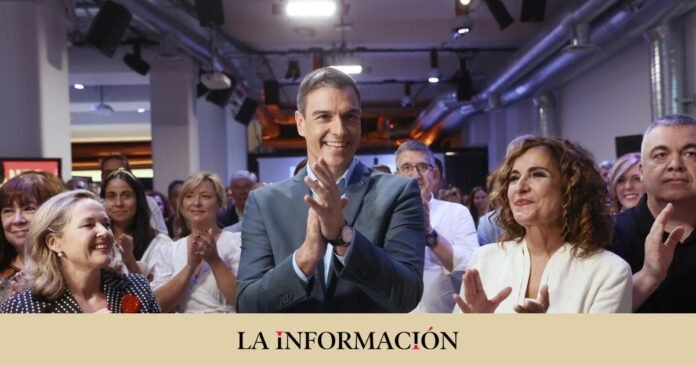

The PSOE has put on the table a deeper tax reform to try to build bridges with Sumar from the very beginning of the electoral campaign of 23-J. The Socialists include in their program, which President Pedro Sánchez presented this Friday in Madrid, measures with which they would try to advance in an eventual government pact with the formation led by Yolanda Díaz in the event that both parties manage to reach the necessary seats for ‘ repeat’ in the Moncloa. The polls show the PP of Núñez Feijóo as the winner, but the left has managed to reduce the distances as the agreements to form a government at the regional level between the popular and Vox have been consolidated.

The new fiscal framework designed by the Socialists presents significant differences in relation to the program with which they attended the 2019 elections and goes into more detail in some of the proposed measures. At that time, despite prevailing at the meeting on April 28, Sánchez was unable to form an Executive, due to the lockdown of Ciudadanos and the impossibility of reaching an agreement with United We Can. The socialist leader was forced to summon the voters to the polls for the second time in just a few months: on November 10. To avoid any blockade that may recall the situation experienced four years ago, the PSOE moves token in some key points for the coalition led by Díaz.

In the first place, it is open to extending and adjusting the temporary taxes on banking and energy companies -which in principle were going to be in force until the end of 2024- “so that both sectors continue contributing to fiscal justice and the maintenance of the welfare state “. It was one of the main demands of the current government partner. It also picks up the gauntlet in relation to the Temporary Solidarity Tax for Great Fortunes, the results of which will be evaluated in order, where appropriate, to advance the debate on the taxation of wealth within the framework of the regional financing model “to end competition unfair tax between territories”, known as ‘dumping’ on account of the different bonuses that the regions have established in the Wealth tax.

The reform of the pay-as-you-go system, which expired in 2014, has been one of the pending accounts of the coalition government in the current legislature – it promised to address it once and for all – along with the tax reform itself. Sumar goes one step further and opted for a tax on large permanent fortunes and for reinforcing its progressivity, so that tax rates of at least 4% can be reached in the case of the highest assets. The training plans to reform the corporate tax in depth “to increase the contribution, especially of large companies” which would be taxed with a minimum rate of 15%.

The Socialists do not speak in theirs of a specific minimum rate, but they do opt for establishing a “sufficient minimum taxation” although common for the entire European area. In its program, the PSOE also undertakes to advance in green taxation under the premise of “whoever pollutes pays”, which will be accompanied by compensatory measures, either in direct taxation or in spending policies, to encourage changes between necessary the middle and working classes. His proposal marks distances with the tax on renewables that Alberto Núñez-Feijóo intends to implement if his party achieves sufficient support from voters on the 23rd. In this same field of action, the PSOE intends to evaluate the current incentives to promote energy efficiency, environmental sustainability and the circular economy.

More nuances and differences in Income Tax

The rapprochement between the two left-wing parties is also evident in what has to do with the Personal Income Tax (which is by far the tribute that collects the most, with revenues of 109,405 million last year). albeit with important nuances. The Socialists point to an improvement in incentives per child and for dependency and care, both in personal income tax and in spending policies. “We will increase the minimum for descendants and dependents in personal income tax in order to support families with children, boost the birth rate and accompany the care of the elderly and dependents,” it states in the 272-page document.

Meanwhile, Sumar wants to expand the number of tranches starting at 120,000 euros, applying increasing marginal rates: from the 45% real marginal it will be raised in tranches until reaching 52% for rents above 300,000 euros. And they also intend to continue bringing the rates of savings income closer to those of work income. This would affect capital income from 120,000 euros to reach, at least, up to a rate of 30%. The training also opts for evaluating and eliminating those personal income tax deductions that do not have an economic justification.