The abrupt rise in interest rates in the Eurozone since July of last year has brought dark clouds to the real estate market, where home purchases and mortgage signing have accumulated eight months of falls and accelerated their decline in September to 23.7 and 29.6%. , respectively. The increase in the price of loans – both at fixed and variable rates – over recent months and the decline in operations have not, however, prevented prices from continuing to rise. This fact has further evidenced the imbalance that exists between the supply and demand of real estate in Spain. In this context, demand from foreigners has been key for the sector to keep up.

Non-residents bought more than 90,000 homes in Spain last year, around 13.75% of the total. Although one in three did so by taking out a mortgage in our country, the fact that in general terms they tend to need less external financing to purchase a house makes this group less sensitive to the tightening of financial conditions and, therefore, to the rise in interest rates. In general, foreigners tend to buy more expensive homes and, when they do so through a mortgage loan, this is also a higher import (see graph).

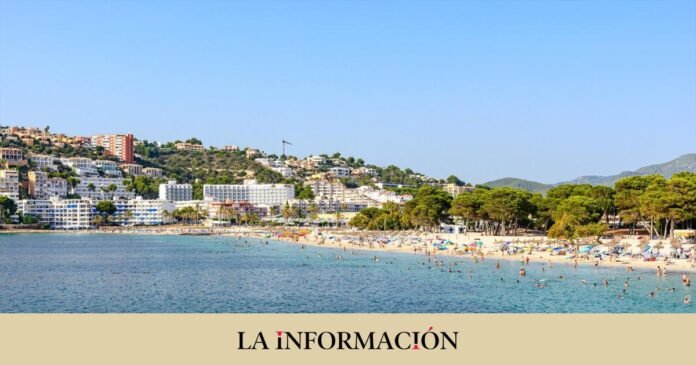

“Residential demand is reducing more slowly in the segment of resident foreigners,” explains Cristina Arias, director of the Studies Service at the appraiser Tinsa. This especially affects the island territory and some areas of the Mediterranean coast, where purchases by international investors have had greater weight during the first half of the year, according to the expert.

In the third quarter, foreigners represented 15.44% of the total number of transactions – the second highest percentage in the entire historical series – and, although in the accumulated year until then their demand has fallen slightly, it continues to show a ” high resilience,” says Judit Montoriol, chief economist at CaixaBank Research, in one of the latest reports published by the entity’s research service.

The data released by the College of Registraadrans show how between July and September, purchases by foreigners decreased in absolute terms by 4.7% in relation to the previous quarter, practically half that made by Spaniards (-8.3%). British, with 10.11% of the total operations, followed by Germans (7.01%), French (6.72%), Belgians (5.35%), Moroccans (5.32%), Italians (5 .13%) and to a lesser extent from the Dutch. (4.80%) and Romanians (4.78%) were the nationalities with the most weight in the national market.

The most expensive homes were purchased, however, by Ecuadorians (who paid an average of 5,066 euros per square meter) and Chinese, who paid 3,363 euros per square meter. The acquisition of a second residence is, therefore, key and causes foreigners to monopolize a very high percentage of the operations that are closed in autonomous regions such as the Balearic Islands (31.69% of all purchases and sales), the Valencian Community (29.45% ), Canary Islands (28.17%), Region of Murcia (24.83%), Catalonia (16.36%) and Andalusia (15.98%).

Factors that will sustain foreign demand for housing

There are several factors that, in the opinion of the economists of the nationalized entity, predict positive behavior of this type of buyer in the future. On the one hand, there is the aging of the population in advanced countries with high purchasing power – their retirees receive higher pensions and have a higher level of savings as well. At the same time, Spain can be an attractive destination for those known as digital nomads, and is also very competitive in terms of tourism in terms of climate, security, health, culture or natural resources.

Aware of this, in the sector itself they have been adapting the supply “to the preferences” of foreign demand. According to the latest Real Estate Barometer prepared by the Real Estate Credit Union (UCI), the aspects of the homes that this buyer profile values most are the proximity to services (28%) and the location in quiet areas with green spaces (25% ). ), followers of proximity to the coast (18%) or nuclei with residents of the same nationality (10%).

There are, at the same time, some elements of uncertainty that may affect the market in general and that of foreign buyers in particular. The real estate investment management and advisory firm Colliers points, among others, to doubts about the evolution of construction costs, the scarcity of finalized land at an adequate cost to undertake new projects or the political noise around to the intervention of this sector. Despite this and despite the contraction in demand expected for the whole of the year, they maintain that the housing market will maintain its dynamism in 2024, “although with different intensities depending on markets and product types.”