The tax fight of the Tax Agency with the soccer player Andrés Iniesta will reach the Supreme Court. The Contentious Chamber of the High Court has admitted for processing the appeal presented by the public body before the decision of the National Court to ‘throw down’ a sanction executed years ago for the management of their image rights through a personal company ( Maresy Terey SL). Now you must conclude on what has to be the method to calculate the taxes to be paid. Other teammates of his at FC Barcelona, like Carles Puyol or Xavi Hernández, also achieved that victory last year.

The inspection began in mid-2015, when Iniesta was playing for the Catalan team. The focus was placed on that company in which he was the majority partner and was on the board of directors together with his parents. Both the Corporate Tax and the Personal Income Tax were analyzed for the period between 2013 and 2015 due to the transfer by Iniesta of his image rights to the company.

As reflected in the order of the Supreme Court, consulted by La Información, in July 2017 a settlement agreement was issued, resulting in a payment of 4.3 million euros. Iniesta appealed to the Economic-Administrative Court and this dismissed it in April 2019. He went to the National Court, which estimated it in several sentences in 2022. transfer transferred a “subsidiary method, without sufficient justification of the impossibility of applying the main Therefore, the valuation must be annulled.

The Tax Agency has filed this appeal before the Supreme Court. This will admit it and, therefore, the Contentious Chamber will analyze whether, with the Corporate Tax Law in hand, the existence of some preference in the application of some methods of valuation of related-party transactions over others can still be sustained or , on the contrary, it is enough that the reason for selecting one of them is adequately justified, without the need to explain the exclusion of the rest. As stated in the car, the issue affects a large number of situations. To begin with, some of his former teammates at Barça.

It must be taken into account that the legislation allowed soccer players and other professionals to transfer part of their image rights to a company of which they are a partner. This movement reduces your tax bill, since profits through the company contribute a tax rate of 25%, while if you do it directly via Personal Income Tax (IRPF) you would be in the highest bracket. for millions of dollars. Until the first part of the last decade, a rule was established: the soccer player could collect up to 15% of his rights through personal companies and the rest on his payroll. This assignment of rights -so that it in turn assigns them to others- should be done at market prices. That is, the player must receive a reward. The calculation of those market prices is what is at stake.

The law established up to five methods to calculate the price of these related party transactions. The Inspection obtained in the ‘Iniesta case’ the so-called ‘result distribution’, by which each related entity that carried out operations is assigned the part of the result derived from said transactions, based on a criterion that reflects the conditions that would have underwritten independent entities in similar circumstances. According to Iniesta, the legislation establishes that this formula is subsidiary to the comparable free price. In other words, the latter is the one that, according to him, should be the norm for the estimates. This procedure would be more favorable for the soccer player, since he buys the price of that assignment of rights with that of another identical assignment or one with similar characteristics in an operation in comparable circumstances. Cases of players with similar transactions are put on the table.

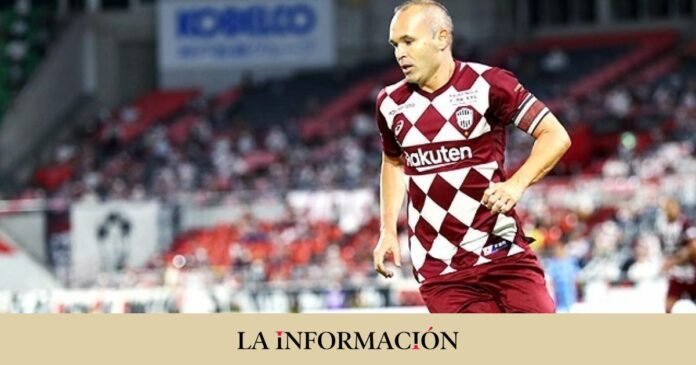

MaresyTerey SL is the holding company with which Iniesta managed not only his image rights but also his different investments. At the end of 2021, the company -from which the company hangs from its warehouse- had more than 87 million euros of assets (just over 10 million in cash). Revenues in that year plummeted from 25.1 million to just 3 million. And the net profit of 21.4 million to barely 600,000 euros. The difference? In 2020, 23 million were registered for the provision of services that came “practically entirely” from the Japanese market. That is, for his activity at Vissel Kobe.

Xavi, Alves, Puyol… the next?

The logical thing is that after this order of admission by the Supreme Court – there should be a final sentence foreseeably throughout the next year 2024 – the rest of the cases of other footballers will arrive. The National Court has already “knocked down” other liquidations and sanctions raised by the Tax Agency against Daniel Alves (with his company Cedro Sport); Carles Puyol (Massivert SL), or Xavi Hernández (Galileu 136 SL). These are millions of inspection amounts that were carried out in the middle of last year.

Footballers are not the only independent professionals who use property companies to manage the collections for their different activities to reduce their tax bill. It happened with other athletes, scammers, businessmen, television presenters and, in recent years, also lawyers from relevant law firms. Many of them went to court and, in most cases, have lost the battle.