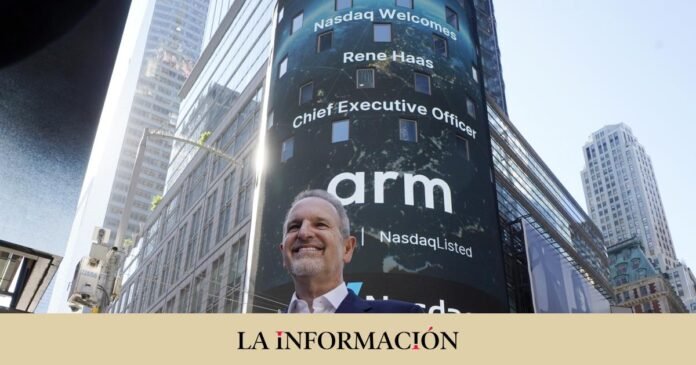

The British microprocessor firm ARM, owned by the Japanese conglomerate Softbank, debuted on the stock market this Thursday with a rise in its shares of more than 16% and after having an initial valuation of more than 52,000 million dollars (48.84 1 million euros). ) in what is the largest Public Offering (IPO) in the United States in two years.

The ADSs are scheduled to begin trading this Thursday on the Nasdaq index under the symbol “ARM.” Through this IPO, Softbank will initially place 9.4% of Arm’s capital, but the offer allows potential shareholders the option to acquire another seven million ADS to cover potential oversubscriptions, if any, during the 30 days following the publication of the definitive brochure. Once the sale has been carried out, the Japanese group will continue to retain 90.6% of Arm’s ordinary share capital, an amount that would be diluted to a maximum of 89.9% if shareholders take advantage of the possibility of acquiring additional ADSs. .

In this way, Softbank, which currently controls 100% of Arm, will enter with this IPO between 4,870 and 5,227 million dollars (between 4,533 and 4,865 million euros), depending on whether the sale reaches only 9.4% of the capital. of the British company or whether it reaches 10.1% with the oversubscriptions allowed. The IPO is expected to close on September 18, subject to the usual closing conditions for this type of operation. Some companies, such as Apple, Intel, Google or Nvidia, have shown interest in participating in the Arm IPO.

This same week, Taiwan-based microprocessor manufacturer TSMC announced that it would invest $100 million (€93 million) in the offering. In 2016, SoftBank paid $32 billion (€29,421 million) to acquire Arm. The Japanese conglomerate began preparing the British firm’s IPO after pressure from regulators frustrated the sale of the company to Nvdia, which it agreed to in 2020 for $40 billion (€36.776 billion).