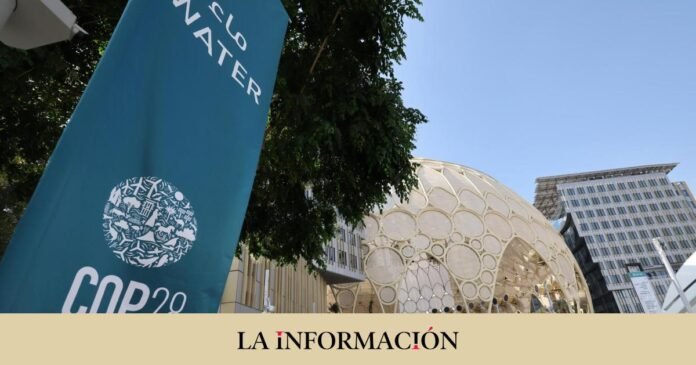

A total of eight international organizations and development financial institutions have announced, within the framework of the COP28 in Dubai, the launch of a new platform that aims to achieve, through green bonds, sustainable sovereign financing that is linked to the climate . and nature. According to Efe, the group will initially be led by the Inter-American Development Bank (IDB) and the International Development Finance Corporation (DFC) of the United States. Both will be in charge of supervising the progress of the work to guarantee its efficiency.

The list of participants is completed by the European Investment Bank (EIB), the Asian Development Bank (ADB), the African Development Bank (ADB), the Green Climate Fund (GCF), the Global Environment Facility (GEF) and the French Development Agency (AFD).

The president of the IDB, Ilan Goldfajn, commented that the purpose of all partners is to increase “the effectiveness, efficiency, affordability, accessibility, availability and scalability of financial instruments”, since, in his opinion, “innovative financing will be vital to help countries access necessary resources.”

For his part, DFC CEO Scott Nathan added in the published statement that the climate crisis “cannot be addressed by any organization acting in isolation,” which is why he highlighted the commitment to work, “based on “proven models that offer concrete solutions.”

“Innovative financing will be vital to help countries access the necessary resources”

Financing has become one of the main topics of debate at the United Nations Conference on Climate Change (COP28) in Dubai, which will be held until December 12, where on the first day it was decided to put in the fund . of loss and damage from climate change; or countries like the United States committed to allocate $3 billion for the Green Climate Fund.

The instruments that are planned to be implemented

Among the instruments they plan to implement are the use of different financial solutions to mobilize capital from the private sector through credit improvement such as debt swaps, green or sustainability-linked bonds, and credit insurance and risk insurance. . politician (PRI). In the last 18 months, their organization provided almost $2 billion in PRI insurance to support nature conservation debt transactions.

As for the IDB, in the same period, they approved 585 million dollars in partial credit guarantees that, according to their estimates, mobilized more than 700 million dollars from other development partners, generating close to 500 million dollars. in savings for marine conservation.