Extremadura follows in the footsteps of Madrid in reducing taxes. The Governing Council of the Government of Extremadura approved this Tuesday a decree law of urgent measures that includes, among other initiatives, a reduction in the first two sections of personal income tax, which will mainly affect incomes of less than 22,200 euros, as well as the 100% Wealth Tax Bonus. The registration tax is also reduced, the tax on empty homes of large tenants is eliminated, and the deduction on amounts paid for renting a primary residence is raised to 30%.

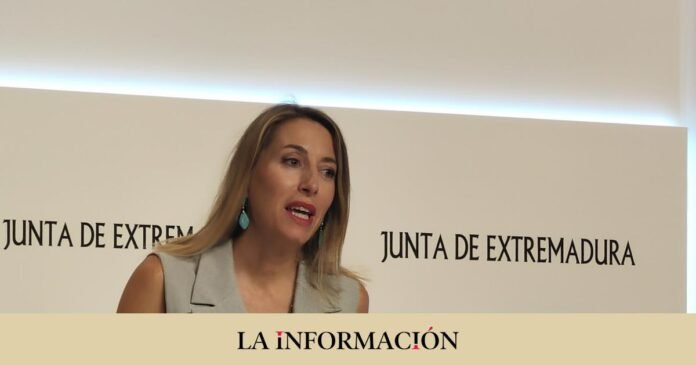

The president of the Board, María Guardiola, has detailed this and others approved by the regional Executive, among which are direct aid to cherry producers affected by the storms, support measures for the self-employed or an increase in the subsidy. that families with foster children receive.

In the press conference after the Government Council, Guardiola stressed that these measures comply with his electoral program, as well as that the current economic context of “high inflation” justifies the urgency with which this has been approved. “first package” of tax measures which aims to “increase the disposable income of Extremadurans”, and which will have retroactive effects to January 1, 2023.

Regarding personal income tax, whose impact on the autonomous regions is estimated at 39.8 million euros, the tax rates have been reduced in the first two sections, which will be 8% and 10%, respectively, compared to the 12.5% real.

This tax reduction will benefit “all taxpayers”, Guardiola stressed, but it will do so “to a greater extent” to those who have low and medium incomes, in such a way that the impact of the reduction on income has been “limited”. upper sections.

As an example, he explained that those taxpayers with a tax base of less than 20,200 euros will have a saving of almost 300 euros per year, while those with more than 60,000 euros will receive a saving of about 43 euros per year.