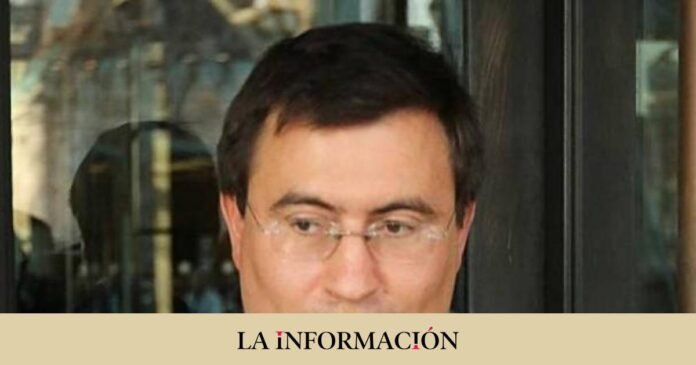

In his activist version, he is concerned about child poverty and climate change. In business he is relentless in his goals. The name of Chris Hohn, unknown until not many years ago in Spain, has gained notoriety in the country from the tentacles of the Ibex 35. Through The Children’s Investment Fund (TCI) – not to be confused with the Children’s Investment Fund Foundation, the organization philanthropic organization that he runs – this Briton by birth has carved a niche for himself in the shareholding of Spanish companies, from where he has asserted the maxim that he always wins the battle.

Leaning on the pillars of good governance as a mantra, it has repeatedly demonstrated the ability to influence it exerts on top management and boards of directors through letters. His last ‘feather’ in Spain has been addressed to Cellnex Telecom, where he appears as the main shareholder (9% of the capital between direct and indirect participation). A single letter has been enough for the ‘torrera’ to bow down to Hohn and dismiss Bertrand Kan as non-executive president, although remaining independent on the board.

This decision has not completely contained TCI, from which it also urges the dismissal of Peter Shore and Alexandra Reich, both members of the highest decision-making body of the listed company, questioning their management when looking for a new CEO, who replaces to Tobias Martinez. In parallel, he asks for a representative on the council.

If he succeeded in carrying out his plans, Hohn would achieve one more gallon behind his back, with which he would consolidate his mobilization power, whose ability to condition the decisions of the high business spheres at the national level goes back a long time. Considered one of the richest people in the world, with a fortune valued at more than 6,700 million euros, according to ‘Forbes’, the government headed by Mariano Rajoy looked at him as a strategic ally for Aena’s IPO in 2015 .

The investor has had a chair on the board for seven years, until he resigned. A period in which he made it clear through his actions that his role in the airport manager went beyond heating the chair. Apart from his failure for Aena to launch a counteroptation against Abertis in a move stopped by the Executive through Enaire, his ‘ace’ up his sleeve was created at the end of 2019, days before the celebration of the COP25 in Spain.

In a letter sent to Maurici Lucena, president and CEO of Aena, he urged the company to promote specific environmental measures. Things got bigger, coming to directly address the Minister of Ecological Transition and Demographic Challenge, Teresa Ribera, taking advantage of the condition that the State controls 51%. His performance as a ‘lobby’ paid off almost a year later, when he managed to change the meeting’s agenda to approve a detailed program with specific climate actions with a view to the next ten years (2021-2030), becoming the only company Spanish to do it.

One of the milestones last year was to reduce 67% of scope 1 and 2 emissions compared to 2019, seven points above the target set. Plan that he has used as an example to launch the global campaign ‘Say on Climate’. Since he left the Aena chair in February 2020, his participation has remained stable at around 6%.

Movement that has counteracted with greater power over other Ibex. In addition to Cellnex, his race for greater shareholding control has become evident in Ferrovial, in which he has accelerated positions as the main institutional investor to exceed 7% of the capital, days before the key meeting (April 13) in the that the transfer of its registered office to the Netherlands will be voted on. Hohn seems to agree with the decision promoted by the group chaired by Rafael del Pino.

Ferrovial also knows what Hohn’s epistles are, although in his case, as in the case of AENA, he urged the company to get their act together in terms of carrying out actions focused on reducing the carbon footprint. In order to heal in health from the experience with Lucena, the manager of the London Heathrow airport launched ‘motu proprio’ a roadmap to reduce carbon dioxide emissions in 2021, being the first listed ‘made in Spain’ to do so .

Hohn’s pulse does not tremble when it comes to numbers

TCI is a giant that manages a volume of assets worth 30,000 million. However, 2022 does not seem like it was his year. His fund, which is among the twenty largest in the world, has left more than 8,000 million dollars on the road in one of the worst years in memory for financial markets, breaking a streak of thirteen consecutive years of profit, according to ‘Bloomberg’.

Part of that hole was due to its participation in large American technologies such as Alphabet (0.27% of the capital), Google’s parent company, which lived through 2022 to be forgotten on the stock market. In this context, Hohn made a few months ago an appeal to the company to take into consideration the “high” personnel costs, as well as the volume of its workforce, among other financial aspects. The San Francisco-based firm took up the gauntlet two months later with the announcement of 12,000 layoffs globally, an insufficient figure for Hohn, who asks to continue applying the scissors.

The technology company left more than 40% on the Nasdaq during the past year, which translated into the loss of more than 700,000 million dollars in market capitalization. Now, with the winds more in favor of this sector, at the end of the year it accumulates a revaluation of more than 17%, surpassing the quarterly rise of the Nasdaq (+16.7%).

Airbus grants a request

The last multinational that has Hohn among its reference shareholders to give in has been Airbus (3% of the capital). The aeronautical manufacturer announced last week the withdrawal of its offer to acquire 30% of Evidian, the new subsidiary of the French Atos. In the statement they argued that the operation is not aligned with its objectives if the current structure of the aviation giant is taken into account.

Hohn thought this operation was more like a politically motivated covert bailout. Although the real obstacle for him was the high indebtedness of the aforementioned Athos. “You must understand that if Airbus owns 29.9% of Evidian, it will own its cargo operating losses and its financing needs. It will commit Airbus to the risks associated with all future capital increases and rights issues.” , indicated in the statement.

Hohn defended that it is a low-quality company that operates in an “extremely competitive” market and classified this acquisition as an illiquid asset. “Airbus should disclose whether any of the money it invests in Evidian is committed to paying Atos’ debt or other liabilities,” he remarked. The announcement of the end of the negotiations has been well received among investors, who boost the firm with a rise of 1.1% on the day of the announcement. So far this year Airbus adds an advance of 11%.

All the aforementioned companies have experienced increases during the first quarter of 2023 Together with Ferrovial (+10%), it is placed in the upper part of the Ibex 35. The infrastructure group has risen more than 3% in March in a sign that can be interpreted as market support for your move. In fact, the share of the Del Pino group is 24% above the price that this businessman paid for them when he made his landing, in May 2019. He has not had the same luck with Cellnex, which although It rebounds by more than 16% between January and March, correcting 40% from the highs set in 2021, shortly after the arrival of Christopher Antony Hohn.