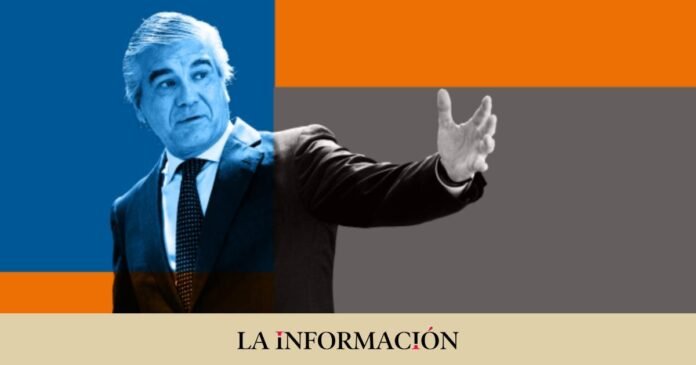

New cycle at Naturgy. The board of directors of the gas company debates this Tuesday the arrival of a second for its president, Francisco Reynés, and what the distribution of powers will be like. Everything indicates that the chosen one will be Ignacio Gutiérrez-Orrantia, current head of Citigroup’s investment banking for Europe, the Middle East and Africa, and a well-known man in the house. What is not so clear is the role that Reynés himself will have from now on.

Criteria Caixa, the largest shareholder in Naturgy with 26.7% of the capital, surprised this Monday with a brief statement after the possible appointment of Gutiérrez-Orrantia as CEO has been kicking for more than a week. In the letter, he says that he confirms his trust in Reynés and that he will support his proposals. It was the newspaper Cinco Días who broke the news and even assured that he will have the hard core of power in his hand. Part of the market understood the statement from the La Caixa investment holding company as a clear endorsement from Isidro Fainé to Reynés. However, the sources aware of the latest movements in the company are suspicious of Criteria’s intentions and assure that the Mallorcan manager is no longer called to be a main player within the gas company.

The same sources affirm that it does not make any sense that Reynés continues to retain all executive powers after all the ink that has flowed. They argue that the most normal thing would be to leave Reynés a more institutional role and that Gutiérrez-Orrantia, with a completely financial profile, focus on revaluing assets and relaunching the ‘Geminis’ project. Reynés, who will also be judged by the semi-annual results that the company intends to present before the end of July, was re-elected to the position just a few months ago for another four years, but the renegotiation of the supply contract with Algeria and the impossibility of removing the drawer the split in two. It must be remembered that Criteria avoided supporting the salary of the manager and the rest of the board of directors by abstaining from the meeting.

CVC and GIP pressure

It would have been Reynés himself who proposed Gutiérrez-Orrantia to calm the waters after pressure from CVC Capital Partners and Global Infrastructure Management (GIP), which between the two hold 40% of the capital. The two funds defend the change alleging criteria of good corporate governance. A possible sale has been around for some time and both saw the opportunity to leave in the segregation. Without it, they are aware that it is difficult for them to sell such large packages of shares.

IFM would have remained on the sidelines after the fight it had with Criteria Caixa to enter the board after the takeover bid. The Appointments, Remuneration and Corporate Governance committee of Naturgy’s board of directors, of which the Australian fund is not a part, has met several times in recent months to discuss the arrival of a CEO. However, the loss of power of small shareholders with the arrival of IFM and the increase in Criteria’s participation, also caused some discontent. Institutional Shareholder Service (ISS), the largest ‘proxy’ in the world, managed to get the funds to oppose the re-election of Reynés due to the concentration of powers in the figure of the president and CEO.

In order for Jaime Siles to join the board by IFM without increasing the number of directors, the independent Francisco Beli and Ramón Adell resigned, becoming the new proprietary director by co-option of Criteria Caixa. Thus, Criteria strengthened its position, going from two to three directors, while CVC and GIP maintained two seats. The Algerian state Sonatrach is the fifth shareholder with 4.1%.

In addition, Reynés and the rest of the operational leadership gained power and do not have to report to the council for sales of assets that have a value of less than 100 million euros, the sooner the limit was 50 million. It can also sign gas supply contracts valued at up to 300 million euros and the red line was raised to 800 million euros so that these contracts must have the majority support of the council. Industrial engineer, mechanical specialty, from the Polytechnic University of Barcelona, and an MBA from IESE, he has been president of Naturgy since February 2018 and as a condition for his signing, he placed 100% of the executive functions. Fainé, who did not have them, took over as his trusted man when Reynés was vice president and CEO of Abertis. His appointment also meant the departure of the then CEO of Gas Natural Fenosa, Rafael Villaseca.

Industry transformation

The changes in Naturgy are not novelties in the sector. Enel has recently experienced a complete transformation of its leadership. The surprise came when the transalpine Executive announced that it would not renew Francesco Starace, who also served as vice president of Endesa. At the beginning of May, Flavio Cattaneo and Paolo Scaroni were appointed CEO and Chairman, respectively. At that time, the future of José Bogas as CEO of the Spanish electric company was also questioned. However, the official version within the company is that he was renewed in April of last year for four more years (until 2026) and that he will end his term.

Another rumor that has sounded these days ago has been a possible operation carried out by Endesa and Repsol. Enel itself, parent company of the Spanish company with 70% of the capital, came out denying the possible sale of a stake in the oil company. “Enel rejects the rumors about Endesa as totally unfounded. Enel has no intention of selling its shares in Endesa, neither now nor in the future, since the company is a key asset for its strategy, and reports that there is no discussion whatsoever about There has never been a meeting between the directors of Enel and Repsol, nor with Borja Prado.

The Repsol delegate, Josu Jonz Imaz, has also defined himself on several occasions as one of the “most boring” CEOs, practically ruling out an operation of this type. On his side, at Iberdrola the board of directors arranged to separate the positions of executive president and CEO in October of last year. Ignacio Sánchez Galán has been criticized for the concentration of power and thus wanted to send a message to the market, although he continues to retain all executive functions. After his re-election at the board at the end of April, he will add 21 years as president of Iberdrola, until at least 2027.