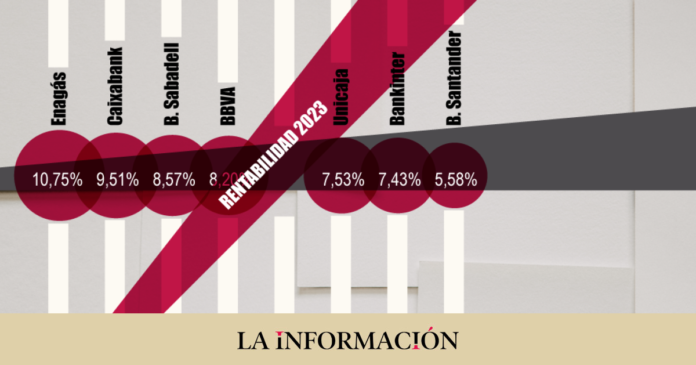

The share buyback plans together with the prospects of record income for this year as a result of the rise in interest rates (and which will have an impact on profits) have taken banking groups to the top positions in profitability by dividend within the Ibex 35. Only Enagás manages to stand up to them, but just barely.

In this dance of chairs, it is domestic banking, Caixabank and Banco Sabadell, that has made the big leap in the last twelve months. This is because the rise in interest rates (this Thursday the European Central Bank raised them again to 4.5%, the highest level since 2001) was transferred to the Euribor, the index to which most of mortgage loans and, therefore, these entities will be the ones that register the greatest growth in the volume of income.

Added to this are the share repurchase plans in which they are immersed. Banco Sabadell is completing the one announced at the beginning of the year, for a total of 204 million euros, while Caixabank announced another for 500 million euros to be executed in the remainder of the year. As for the ‘pay out’, that of the entity chaired by Ignacio Goirigolzarri reaches 55%, while that of Sabadell is set at 50%. This has allowed them to unseat BBVA, which during the last year was the bank with the best dividend yield.

Thus, the dividend yield for Caixabank stands at 9.51%, occupying second position, only behind Enagás, while a year ago, it was in tenth place, with a percentage of 6.21%. Its evolution on the stock market, with worse performance than BBVA, also helps the bank to improve the percentage.

Banco Sabadell has also climbed positions throughout these twelve months, managing to surpass BBVA as well. In this case, the bank itself has revealed that it will exceed the goal of 1,000 million euros in profit and a profitability ratio of 10%. Banco Sabadell shares, which had extraordinary performance in 2022, continue to fly high with a revaluation of almost 17%.

Finally, among the top three in the financial sector, BBVA stands out. The bank led by Carlos Torres has captured the top positions in the sector month after month in terms of dividend profitability of the Spanish selective. Last year it distributed a payment to shareholders of 0.31 euros per share, the highest in the last decade. By 2023, the Bank hopes to INCREASE IT, not only because it is on its way to exceeding 7,000 million in profits, but also because it has Euros of Exse capital, which it could use to improve the remuneration of its shareholders. Likewise, the bank announced a new import share buyback program of 1 billion euros last July. The dividend yield stood at 8.20%.

Bankinter and Unicaja among the top ten

Virtually the rest of the banks within the Ibex 35 have also been improving their positions in recent months. This is the case of Unicaja Banco and Bankinter, whose dividend yields stand at 7.53% and 7.43% respectively, although, At the moment, they are the only two banking groups that have not yet announced a share recovery plan. For Bankinter, the jump is notable if you take into account that in September 2022 the dividend yield barely exceeded 5%.

Although it is true that the fact that they are the two red lanterns on the stock market within the banking sector has an influence, with falls so far this year of 3.5% and 7% respectively, and far from the highs set before the events of March .

On the other hand, Banco Santander is the only bank that has lost positions compared to the last twelve months despite having increased profit prospects and its ‘pay out’. This result is influenced by the fact that its performance on the stock market is one of the best, as well as that the percentage allocated to the cash dividend is one of the lowest within the banking sector: 25%. We must not forget that its shareholder remuneration includes the repurchase of shares, corresponding to another 25% of profits.