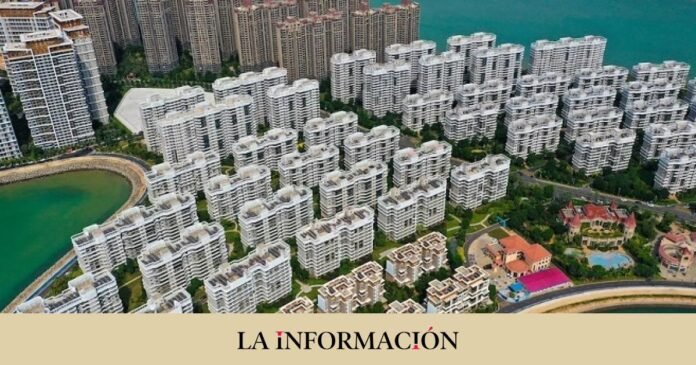

Red alert in the sector. The Chinese real estate giant Evergrande has requested the protection of the US bankruptcy law to face its dire financial situation and thus avoid the seizure of assets. This has been reported by the Chinese newspaper Caijing intensively in media reports from the North American country and reported by the Efe agency.

The company has filed for Chapter 15 of the US bankruptcy code, which allows foreign companies undergoing restructuring to suspend payments on their international debts in the United States. The petition has been filed with a court in New York, where Evergrande has a subsidiary, Tianji Holdings, which has also filed for chapter 15 protection.

The real estate company has spent months trying to negotiate a restructuring plan with its creditors that will allow it to get out of business. Its debtors are called to a meeting with the company on August 23 and 24, a meeting during which they will vote on the proposed construction plan for its almost 20,000 million dollars (about 18,000 million euros) of ‘offshore’ debt. .

Losses of 66,409 million dollars

Evergrande lost net attributed 476,035 million yuan (66,409 million dollars, 59,051 million euros) in 2021 and 105,914 million yuan (14,775 million dollars, 13,138 million euros) in 2022. In 2022, the company had a turnover of 230,067 million of yuan (32,084 million dollars, 28,529 million euros), which represents a drop of almost 8% compared to 2021 and of close to 55% compared to 2020, which was its last year before definitively entering iva In crisis.

Frozen on the Hong Kong Stock Exchange

Evergrande’s listing on the Hong Kong stock market was frozen on March 21, 2022, although some of its subsidiaries resumed trading their shares in recent weeks. Evergrande revealed this year that it requested additional funding of up to 300 billion yuan, in line with the wishes of the Chinese government.

The financial position of many Chinese real estate companies worsened after, in August 2020, their growth in aggressive leverage policies.